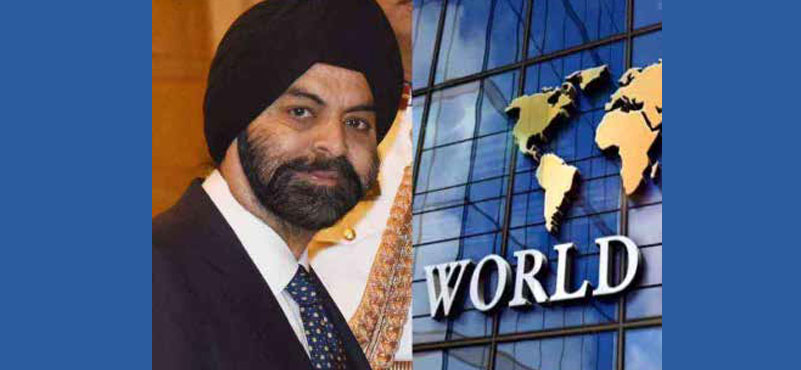

Banga, 63, took over as the president of the World Bank last month, becoming the first person of colour to head either of the two global financial institutions — the World Bank and the International Monetary Fund.

India’s economy grew 7.2% in FY23 and the World Bank expects it to grow 6.3% in FY24. Banga emphasised that India can maintain this momentum and that growth and jobs are the best way to tackle poverty. On demographic dividend, he said the number of jobs that needs to be generated is 15-20 million – some of which will come via manufacturing and technology while a large number would be in the services sector.

Banga was in India for the first visit after assuming charge of World Bank. An alumni of Delhi’s prestigious St. Stephen’s College, he was here to attend the G20 meetings in Goa; while in Delhi, he met finance minister Nirmala Sitharaman and spoke about the G20 bloc, whose presidency India currently holds. He also discussed cooperation between the World Bank and India.

We reproduce extracts of his interaction with the media in Goa and Delhi. Important statements from a person who will have a decisive say in the global economy, in the years ahead.

On the world economy and where India and the World Bank can work together.

Domestic consumption provides natural cushion to the Indian economy against the global slowdown as bulk of the country’s GDP depends on local demand.

India has proven more resilient and emerged from the pandemic relatively stronger than others.

India is the largest market for the World Bank in terms of our portfolio here. There is a lot of interest here

There is more risk on the downside in terms of a slowdown in the early part of next year. I think we did better than we all thought. But I still feel that there’s more risk on the downside in terms of a slowdown over the early part of next year.

On Supply chains and disruptions

The opportunity currently is to cash in on the China+1 opportunity. This opportunity will not stay open for 10 years. This is a three-to-five-year opportunity when the supply chains start relocating or say not relocating but adding on in another location.

The one thing India has going for it is the percentage of gross domestic product (GDP) that comes from local production. Your exposure to the typical impact of global slowdowns, caused by trade slowdown, etc is cushioned by the relatively high percentage of the economy that comes from domestic consumption, which is very helpful at a time (like this).

On the aftermath of Covid

The gains made across the world to reduce poverty in the past three or four decades have faced a setback because of the Covid pandemic, climate change, fragility, wars and high debt. The best way to drive a nail in the coffin of poverty is growth and jobs.

I am actually more optimistic today, with all the infrastructure that’s going on, investment – digital and physical, skilling infrastructure.

On the future lending by the World Bank

The US has already indicated that they were going to commit to some…The first is to take our loan-to-equity ratio from 20 to 19, which does not require any additional money to come in, it is our own handle to manage it.

For every $1 billion that comes in, the capacity to lend over a decade increases by $5-7 billion, depending on the repayment patterns. We will need a pool of bankable projects that are ready.

The World Bank has created a private sector investment lab headed by former Bank of England governor Mark Carney and 15 CEOs to identify the barriers to growth of private sector investments.

We can do a few things to help take away a few of the risks that the private sector does not understand in the emerging markets. It could be foreign exchange, regulatory policy, political risk insurance.

On meeting with the Finance Minister

India will be shielded from risks of global slowdown. Besides, there were discussions between the finance minister and the global lending head regarding India’s sectoral priorities like municipal financing, logistics, recycling of water, and renewable energy grids, for seeking assistance from the World Bank Group in leveraging private investments and how India and World Bank could cooperate to further the Group 20 agenda.

The finance minister mentioned that bridging the knowledge and technology gaps is key to future economic development and the World Bank should accelerate efforts to share the Indian development experience with the Global South, said the finance ministry in a tweet.

About India’s potential growth in high-income jobs India has an opportunity to cash in on global firms’ efforts to build factories outside China, as companies seek to diversify their supply chains.

We need to understand where these jobs are. They are in technology, which is very few… then they are in manufacturing.

On being prudent with your money

We are actually fighting many crises. Let us all make sure we are using the money we already have in the best possible way. Where you are standing right now. This entire skilling idea emerged from a World Bank conversation with the Prime Minister very early in his first tenure. India is doing a lot of things which has allowed it to stay ahead.

Most countries would be very happy with a 7% growth rate in this environment.

On private sector involvement

The fact is that kind of money you cannot get from governments or multilateral banks alone or even philanthropies. You must get the private sector involved. The question is, we have created a private sector investment lab that will help us understand how to do this well. The fact remains, you will need different forms of concessional capital. You will also need different forms of multilateral bank capital and government capital and philanthropy capital to take first risk positions or to help enable the blended finance to come through. So, the real issue is if that is what you need for renewable energy, but we are actually fighting many crises. We have got climate issues, we have got issues with fragility, conflict, pandemics, and future healthcare needs. And underlying all this, we have the issue of fighting poverty and creating jobs for people. So, I think the requirements are immense. The way I have approached this is let us all make sure we are using the money we already have in the best possible way. Once we finished that, then we should come back to the richer countries and say, what is your ambition for the future? And how much money more are you willing to put? I think the expert group just gives you a broad idea and then we can figure out where to take this.

It’s a trillion dollars just for renewable energy every year in the emerging markets.

On the education sector, the loss during Covid, considering World Bank has been a constant support

You have got to remember that it is not only India that closed schools for the pandemic, the US closed schools down in a number of parts of the country. So, the developed and developing world was learning as this pandemic happened, how to deal with it. And I think there has been lot learning loss across the world. So, we have a real challenge for that generation that was going through schooling at that time. And it is not just India’s problem alone, it’s an issue across the world. My view is that we have just learned now we’ve got to fix what we’ve got, but we must make sure we learn for the next pandemic because otherwise we’ll do this again. The next one will come. It is a question of how long before it does come. That to me is the bigger issue.

On increasing guarantees in other areas like hybrid capital and affordable capital.

So, the first question, what basically the process that we are following is that the evolution roadmap required us to think about all these instruments which we have now working our way through. We are presenting them to all our shareholders, the donor countries, as well as in some cases outside philanthropies and the like. October is when the annual meetings of the World Bank and IMF are being held in Morocco. I think that is the time when you should see commitments from donor countries coming in. The US has already indicated, clearly Secretary Yellen made a very clear statement as you probably heard, that they were going to commit to some, others must commit too. So, I think you will probably see the results of that after that. The first part of the capital expansion is taking our loan to equity ratio down from 20 to 19. That does not require any additional money to come in.

So, the first question, what basically the process that we are following is that the evolution roadmap required us to think about all these instruments which we have now working our way through. We are presenting them to all our shareholders, the donor countries, as well as in some cases outside philanthropies and the like. October is when the annual meetings of the World Bank and IMF are being held in Morocco. I think that is the time when you should see commitments from donor countries coming in. The US has already indicated, clearly Secretary Yellen made a very clear statement as you probably heard, that they were going to commit to some, others must commit too. So, I think you will probably see the results of that after that. The first part of the capital expansion is taking our loan to equity ratio down from 20 to 19. That does not require any additional money to come in.

It’s our own to handle and we can manage. The way this works is for every billion dollars that comes in, we can increase our capacity to lend over a decade by between five and 7 billion depending on the repayment pattern. So, it has a very nice multiplier effect that I am quite keen to make use of.

But the other side of this is you have to have bankable projects. You know, you got go to countries where people are trying to set up development ideas and you have to make sure that good quality projects are ready and available. And one of the things the bank can do, in fact when you go travel in countries, including in India, it is not only our money, it is of course the stamp of good housekeeping kind of thing. But more importantly it is our knowledge. It is our convening power. It is our ability to help inform regulatory policies, to help inform these kinds of things. Where you are standing right now, this entire skilling idea emerged from a World Bank conversation with the Prime Minister very early in his first tenure and he kind of got hooked on it. That skilling changes the opportunity for young people. So, you know, there is more to it than the money. That is what I’m trying to get across. There is also the knowledge bank to be well worked through

Private investments and the kind of project being undertaken?

So, I don’t know yet. We are going to have our first meeting soon. And so, the idea is they will get together once a month and we’ll discuss the kind of things we could do to help the private sector take-away some of the risks it does not understand in the emerging markets. Could be foreign exchange, could be regulatory policy, could be political risk. It will take a few months and then we will see.

On inflation how immune, how resilient will India continue to be in the midst of a global slowdown? And how can India raise its share of manufacturing GDP?

One thing I would tell you, while I did say that I expect that the global economy will have challenges over the next, you know, period of time. It has proven more resilient and frankly, everybody has been proven wrong during this period. So, I would be careful about assuming that people have suddenly learned how to forecast well. I have said that forecasts are not destiny. And I think that is really important to remember. India is doing a lot of things which has allowed it to stay ahead. You’ve just had a great growth year and you most countries would be very happy with the 7% growth rate in this environment. So, I am a little more optimistic about where this could go. My general sense is if there is a global slowdown, the one thing that India has going for it is the very high percentage of its GDP that comes from domestic consumption. Your exposure to the typical impact of global slowdowns caused by trade slowing down, caused by trade in goods as well as services slowing down India’s exposure is cushioned by the relatively high percentage of the economy that comes from domestic consumption, which is very helpful at a time like this.

On digitization

You cannot just do digitization of lending without digitising the infrastructure.

What India has done over the last 15-20 years, it is digitising the infrastructure. I am a big fan of it. I am more optimistic today about India as a whole, economically than I have been for a long time. And that is enabling all these terrific applications to be built, which makes it easier for people to access services online. So, I am a big fan of it.

The fact is the world economy is in a difficult place. We know, it has outperformed what everybody thought, but it does not mean that it won’t be more challenging. The IMF forecast, the World Bank forecasts are that the world will get a little challenging over the next year or so. But as I said, forecast is not equal to destiny. We can change destiny, and that is what you should think about.