Since its inception in 2008, the IPL has transcended the boundaries of traditional sports and established itself as a global phenomenon. Top-notch talent from around the world, unparalleled entertainment, and nail-biting competition has established the IPL has an enterprise to be reckoned with. Today, the IPL stands as a shining testament to the power of sports.

A Houlihan Lokey study in 2023 on the IPL Valuation reveals several interesting trends and facts.

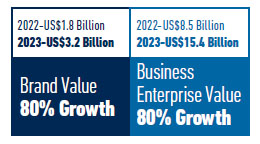

The Business Enterprise Value has seen an 80% growth over last year and has now hit US$15.4 Billion. The Study values the business of IPL using a variant of the income approach known as discounted cash flow (DCF), which is the present value of all future cash flows from the IPL as a business.

The study mentions a key reason for the sharp increase in value to the cost of IPL media rights for 2023-2028. The media rights deal with JioCinema and Disney Star was three times the price of the 2017 five-year deal between Disney Star and the BCCI. The 2023-27 media rights for men’s IPL was `48,390 crore, nearly 50 times higher than that of Women’s IPL. When the IPL’s broadcasting fee is compared with other professional leagues in the world on a per match basis, the IPL fares well above the likes of the NBA, EPL, and Bundesliga and is second only to the NFL.

In 2023, the lead broadcaster Viacom18, streamed the entire season for free on its OTT platform, JioCinema, which enabled it to set a new record for the highest concurrent viewership for a live-streamed event. Around 32 million viewers tuned in to watch the Gujarat Titans (GT) vs. CSK finale on JioCinema. In fact, the broadcaster broke the viewership record thrice this season, with 25 million viewers for the Qualifier 1 and 24 million viewers for the South Indian derby of CSK vs. Royal Challengers Bangalore (RCB). It’s not just JioCinema; television broadcasting partner Disney Star also saw the highest viewership numbers in the IPL’s history, with a 482 million cumulative viewership for the first 66 matches as reported by BARC. Disney Star had more than 30 million viewers for each match, with a peak concurrency of 61 million for the second qualifier between the GT and Mumbai Indians (MI).

In 2023, the lead broadcaster Viacom18, streamed the entire season for free on its OTT platform, JioCinema, which enabled it to set a new record for the highest concurrent viewership for a live-streamed event. Around 32 million viewers tuned in to watch the Gujarat Titans (GT) vs. CSK finale on JioCinema. In fact, the broadcaster broke the viewership record thrice this season, with 25 million viewers for the Qualifier 1 and 24 million viewers for the South Indian derby of CSK vs. Royal Challengers Bangalore (RCB). It’s not just JioCinema; television broadcasting partner Disney Star also saw the highest viewership numbers in the IPL’s history, with a 482 million cumulative viewership for the first 66 matches as reported by BARC. Disney Star had more than 30 million viewers for each match, with a peak concurrency of 61 million for the second qualifier between the GT and Mumbai Indians (MI).

In this comprehensive brand valuation report, the study delves deep into the world of the IPL, uncovering the tremendous value it holds as both a business and a brand. This brand valuation report aims to provide a comprehensive understanding of the IPL’s commercial significance, its impact on the cricketing landscape, and its potential for future growth. The IPL’s media rights have grown at a phenomenal CAGR of 18.0% from 2008 to 2023, while the growth in absolute terms between the 2017 and 2023 cycles is 196.0%.

Coming to the brand value of the IPL, the Lokey IPL Valuation Study mentions an 80% value growth from US$1.8 billion in 2022 to US$3.2 billion in 2023. The brand value of IPL is determined using a relief from royalty method (RFR). Under this method, royalty rate is expressed as a percentage of revenue where it is assumed that the IPL or the individual franchisees would have had to pay a royalty fee for the usage of the brand in a hypothetical scenario where they would have licensed it from a third party.

Coming to the brand value of the IPL, the Lokey IPL Valuation Study mentions an 80% value growth from US$1.8 billion in 2022 to US$3.2 billion in 2023. The brand value of IPL is determined using a relief from royalty method (RFR). Under this method, royalty rate is expressed as a percentage of revenue where it is assumed that the IPL or the individual franchisees would have had to pay a royalty fee for the usage of the brand in a hypothetical scenario where they would have licensed it from a third party.

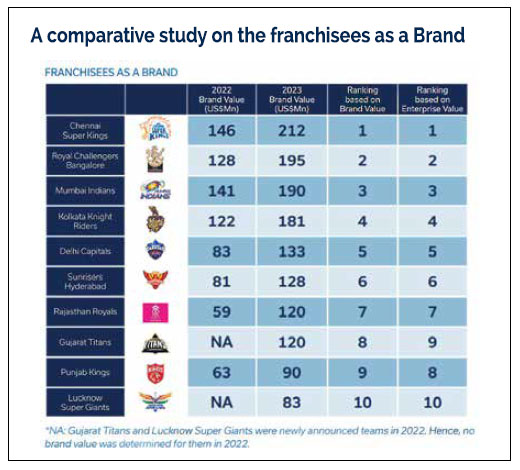

Chennai Super Kings has established itself as an iconic brand in the IPL. With a brand value of US$212.0 million, growing year-on-year (y-o-y) at 45.2%, CSK is ranked No. 1 in both brand ranking and the business enterprise value ranking. Royal Challengers Bangalore is second in terms of brand and enterprise value ranking, with a brand value of US$195.0 million, growing by 52.3% from 2022, surpassing Mumbai Indians. Mumbai Indians (MI), another hugely successful and popular team, is a close third on the table with a 2023 brand value of US$190.0 million, growing by 34.8% from 2022 brand value of US$141.0 million. The IPL franchises have undoubtedly benefited from the renewed broadcast rights deal as well as the ever-increasing popularity of IPL globally.

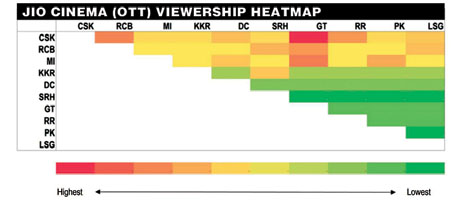

The viewership heatmap of the IPL offers a fascinating insight into the preferences and trends of cricket enthusiasts. Chennai Super Kings’ matches have proved to have a remarkable impact on JioCinema’s viewership figures, attracting a devoted fan base to the streaming platform. Additionally, the intense rivalry between the top three teams has consistently captivated audiences, resulting in a substantial surge in viewership during their encounters. The below chart shows a rise in viewership whenever CSK, RCB, and MI are playing as well as the approximate estimates of the peak viewership of respective IPL matches in the 2023 season. Note that JioCinema recorded a whopping 32.0 million concurrent viewers in the final match between CSK and GT, also shown below.

The viewership heatmap of the IPL offers a fascinating insight into the preferences and trends of cricket enthusiasts. Chennai Super Kings’ matches have proved to have a remarkable impact on JioCinema’s viewership figures, attracting a devoted fan base to the streaming platform. Additionally, the intense rivalry between the top three teams has consistently captivated audiences, resulting in a substantial surge in viewership during their encounters. The below chart shows a rise in viewership whenever CSK, RCB, and MI are playing as well as the approximate estimates of the peak viewership of respective IPL matches in the 2023 season. Note that JioCinema recorded a whopping 32.0 million concurrent viewers in the final match between CSK and GT, also shown below.

According to the SCORE report, a comprehensive IPL ad effectiveness measurement conducted by Synchronize India and Unomer, digital streaming on mobile devices and connected TVs has emerged as the preferred choice for IPL viewers, surpassing traditional linear TV. The report reveals that an impressive 73% of viewers opt to stream IPL matches on digital platforms, while only 27% rely on cable or DTH services. The SCORE report also provides insights into the viewing patterns of IPL audiences. It indicates that 52% of people enjoy the IPL experience on both TV and mobile devices, while 30% exclusively stream matches on their mobile phones. These findings emphasize the changing preferences and habits of IPL viewers, with digital streaming gaining significant momentum over traditional TV broadcasting.

ABOUT

Houlihan Lokey, Inc., is an American multinational independent investment bank and financial services company. Founded in 1972, the company is headquartered in Los Angeles, California.