With numerous agreements signed, a notable missing link was connectivity as perhaps our two countries have an open sky policy and airlines business is totally in private hands.

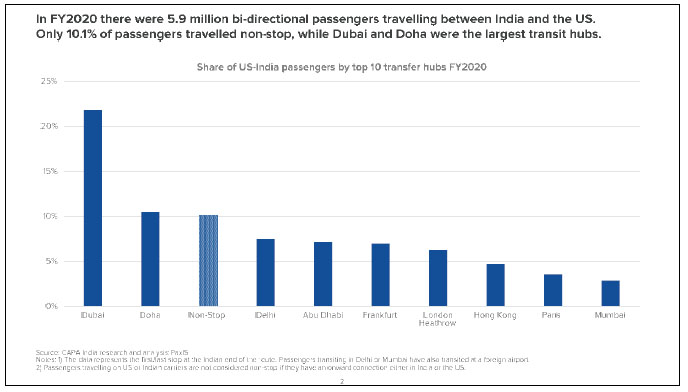

We have a graph that shows the distribution heavily skewed towards one stop traffic and little to direct air connectivity. How much does reflect in sheer numbers?

In FY 20, the US was about 9.1% of India’s total international traffic. However, it is about 27 percent of India’s long and ultra long-haul market.

Is this the biggest country to country traffic?

The US at 5.9 Mn is the second largest OD country market after UAE which is 12.2 Mn, based on FY 20 data and ahead of Saudi’s (5.6 Mn), Thailand (3.9 Mn) and UK (3.3 Mn).

How much is the pattern similar to other country traffic – direct and through third parties?

Indian and US carriers combined carried 26.7% of the total India-US traffic, closer to 74% of the market travels via ME and European hubs. ME carriers account for 40 percent, European carriers at 23 percent and Asian carries at 10 percent. Dubai accounts for 22 percent of the total transfer traffic to US.

Why has direct traffic not grown despite an open skies between the two?

The India-US market has been significantly under penetrated, largely due to the inability of AI (under Govt ownership) to take advantage of the market. The 5-year CAGR prior to Covid was about 5 percent. The potential of India-US is significantly higher – the Inbound/ Outbound/ Business/ institutional and even VFR market segments have massive long-term potential. Jet Airways could not make non-stop work and hence started feeding traffic via AF-KLM/ Delta/ Virgin over Paris/ Amsterdam and London. US carriers also preferred feeding via UK/ Europe via JVs like Atlantic plus. The near freeze on bilaterals to ME carriers and Turkish also constrained the market.

Is there any tangible shift that you foresee now that AI is planning long halt planes?

Air India under TATAs will completely change the dynamics of India-US/ North American market with multiple non-stop frequencies with a world class product and modern fleet. The US network is strategic to AI’s long-haul plans, and we will see AI competing with all the major global carriers with the highest confidence. AI’s fleet on order which includes B777s/A350-1000 indicates the highest priority to the US and North American Markets.

How is the traffic estimated to grow, now that we have this new strategic partnership with the US?

Expect closer to a double-digit growth in the near to medium term led by Indian carriers. Once the bilaterals are relaxed, there will be a further growth momentum to this market. The recent visit of the PM to US will transform trade and investments structurally, providing a long term and stable growth opportunities. The India-US corridor is one of the most fiercely contested markets in the world and with AI keen to be a dominant player, a new era has just begun.