At a time when scaling the inventory is in vogue, Booking.com would rather focus on creating robust relationships with partners than indulging in a race for numbers, says Vikas Bhola – Regional Manager, India Subcontinent. Sharing his thoughts on a wide range of issues, he discusses company’s future plans, impact of home-grown aggregators and much more.

Booking.com along with another online giant accounts for over 60% of the global online luxury hotel inventory. Has the trend been similar in your foray in India? How has India happened for you since you began operations here?

Booking.com along with another online giant accounts for over 60% of the global online luxury hotel inventory. Has the trend been similar in your foray in India? How has India happened for you since you began operations here?

Look, the growth has been fantastic and the first goal of an international OTA like us was to attract international inbound. It was to cater to the demand of foreign travellers. They were, usually, people who were booking 5-star and 4-star accommodation. So our foray was intended in that direction.

Has that worked well for you?

Yes, it did. Till 2014.

What happened after that?

We massively upgraded ourselves more into the domestic segment as well. Our strategy was simple – either leisure or domestic traveller – to provide the largest and widest accommodation options, so that they can, discover, book and enjoy those accommodations.

A prudent strategy, indeed, given that several industry reports and experts suggest that the domestic travel segment is likely to remain the backbone of travel and tourism industry in India. This seems like a strategic alignment to your future expansion, is not it?

The domestic travel segment is hugely important to us. The number of Indian accommodations choosing to list their properties on Booking.com has increased as they see the value we are able to bring them in terms of incremental business and as such we are seeing an increase in the number of Indian domestic travellers using Booking.com.

What is that market share? Do you mind sharing numbers?

Unfortunately we are not able to disclose Booking.com’s revenue figures. Booking.com is part of the Priceline Group, a publically listed company. The Group releases quarterly financial results, like all publically traded companies, but do not break the results down into business specific figures.

What I will say is that the online travel industry in India is a thriving, booming industry and one that we love being a part of. We opened our first office in India in 2012 with around 500 Indian properties and today we have over 16,500. We have grown rapidly and we are one of the market leaders in India in the online travel booking space and we are proud of that. How have we done it? We provide a fantastic customer experience and we build strong relationships with property partners. Customers love using our site because it provides them with a global selection of over 1 million accommodation options, it’s easy to use, and we have over 100 million genuine guest reviews to help travellers make informed choices.

How do you work towards fitting yourself in the mid-segment and low budget hotel inventory space, especially at a time when some of the home grown budget aggregators are scaling up at a pulsating rate? Is it a challenge adopting to the Indian market when much of Booking.com’s engagement has primarily been in the high end segment market?

To start with, I would like to say that today we have over 16,500 active bookable properties with us. A part of our strategy has always been to provide the widest range of accommodation services and partners to customers. So, today we have hotels, apartments, villas, resorts, boats and treehouses. We have the whole variety of lodging that customers can enjoy. What has happened with some of the home grown budget aggregators is that they have brought together an unstructured market. I would say that they have improved the market. So, it is kind of complementary. We have worked with some of them to create better reach for our clientele, but also to get them demand, as well, because of the outreach with have internationally and domestically.

While dealing with 5-star properties, you are sure of the quality of the service. It might not be the case when you work with some of the low-budget segment hotels. How do you ensure that the quality of experience remains standard and of the level that Booking.com has managed to maintain in the past?

We are a platform that provides really good discoverability to our customers. When we are talking about discoverability, we are talking not only about the variety but also the quality of the property. Those quality points are actually in the control of a hotel operator or the partner, as we call them.

The partner controls how we can optimize it. And also, customers who have booked in the past are invited to contribute user-generated content in the form of guest reviews. Our guest-reviews are also a big puller for conversion. Today, we have over 100 million guest reviews on Booking.com. It has been going up. What I am trying to say is that a customer has total control over what he wants to book. The guest can choose a room based on his requirement and prioritize whether a particular property fits his need or not.

Does Booking.com have its own quality monitoring team? Do you do inspections of the property? How does the whole mechanism work?

Our quality checks begin at the moment we are on-board the property. . We are continuously working to bring transparency, choice and value to global travellers. We check the presence of our properties online and on social media to ensure that they are truly represented to customers and encourage our customers to use the over 100 million verified reviews from customers to ensure that the property’s representation of itself on Booking.com matches the customer experience.

Before we open the property to consumers, we on-board the property by giving them training, wherein we explain to them how to create more demand. What is conversion and how they convert on the website. So, we feel that on a wider level, we are not only proving more revenues to properties, but also education of how to operate in the online world.

Low bandwidth and rickety infra bottlenecks in Northeast foray

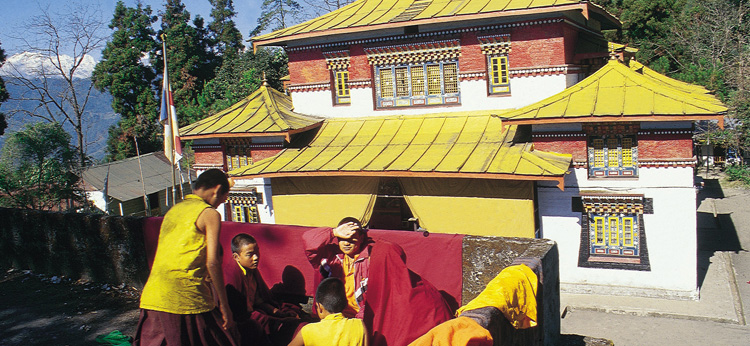

Vikas Bhola remains upbeat about the potential of Northeast as an experience provider for tourists, international and domestic. However, lack of reliable internet availability and plethora of law related issues have hindered the e-commerce giant from a full-scale move into the region, but the company remains positive in its outlook.

What are some key trends, as far as destinations are concerned?

Well, the demand has mostly been for metros. That is typically because much of travel happens there and leisure and business, kind of, combine together. Goa has been doing extremely well; it is a high-demand destination. Kerala is doing very well, too. Some of the destinations in the Northeast, Jaipur, Agra have been performing well. I would say tier-2 and tier-3 leisure-centric destinations are performing well. We see a great demand in those destinations.

Are you primarily operating in tier-1 and tier-2 cities? What is happening in the Northeast?

We have accommodation options in over 200 destinations in India. We also regularly and widely visit the Northeast from a promotional point of view, to build relationship with properties and educate them on the benefits of sites such as ours. The challenge, traditionally, has been the low-internet penetration and bandwidth. Roads and infrastructure needs to be upgraded. Law in some of the destinations in the Northeast require a plethora of permits for foreign companies.

Having said that, the demand has actually gone up in places like Gangtok and Darjeeling. What we plan to do to overcome these challenges is to keep working closely with our partners across the Northeast with more in-person visits and to continue providing education to our partners. We will continue to bring on not only luxury accommodation, but also accommodation for the experience-seeking traveller. The Northeast is such a promising destination. We still do quite a significant amount of booking in the region. It has gone up a fair bit in the last year or so. But the growth has been limited to a small number of properties. Wider number of properties are still working with offline agencies.

We would want to grow faster in contracting properties and get those properties on-board, but at the same time provide them avenues to understand and grow their businesses.