After the withdrawal of `1000 and `500 notes, we introduced the 2000 rupee note; even then there was speculation that this new big note may not last long enough. We need a more transparent and reliable mechanism in line with our aspiration of being a 5 trillion economy.

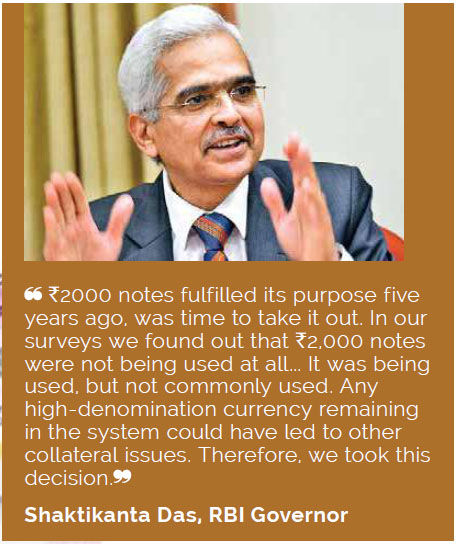

The Reserve Bank of India (RBI) in a Press Release (19 May 2023) has declared that ₹2000 denomination banknotes will be withdrawn from circulation, citing the reasons as “89% of the `2000 denomination banknotes were issued prior to March 2017 and are at the end of their estimated lifespan of 4-5 years. The total value of these banknotes in circulation has declined from `6.73 lakh crore at its peak as on March 31, 2018 (37.3% of notes in circulation) to `3.62 lakh crore constituting only 10.8% of notes in circulation on March 31, 2023. It has also been observed that this denomination is not commonly used for transactions.” Additionally, the RBI referred to the “Clean Note Policy” that was introduced in 1999, according to which banks and financial institutions are required to withdraw unfit/damaged notes from circulation and replace them with new ones.

The Reserve Bank of India (RBI) in a Press Release (19 May 2023) has declared that ₹2000 denomination banknotes will be withdrawn from circulation, citing the reasons as “89% of the `2000 denomination banknotes were issued prior to March 2017 and are at the end of their estimated lifespan of 4-5 years. The total value of these banknotes in circulation has declined from `6.73 lakh crore at its peak as on March 31, 2018 (37.3% of notes in circulation) to `3.62 lakh crore constituting only 10.8% of notes in circulation on March 31, 2023. It has also been observed that this denomination is not commonly used for transactions.” Additionally, the RBI referred to the “Clean Note Policy” that was introduced in 1999, according to which banks and financial institutions are required to withdraw unfit/damaged notes from circulation and replace them with new ones.

The introduction of the `2000 notes after the demonetization exercise that took place in November 2016, and the subsequent ban of `500 and `1000 notes and now the repeal of the `2000 notes seems to impose more cost than gains. At that time, too, the logic of introducing even higher denomination notes (`2000) than `1000 was not understood properly, since the objective was to abolish higher denomination notes only which are susceptible for parallel economy.

Some retail outlets, petrol stations, medical shops were hesitant to accept `2000 notes after the RBI declaration according to media reports (especially petrol pumps). For instance, according to the All-India Petroleum Dealers Association, “The digital payments, which used to be 40 per cent of our daily sales, have suddenly gone down to 10 per cent of daily sales, and our cash sales have increased dramatically, as customers are desperately trying to use `2,000, which will again create trouble for us with income tax authorities.”

Addressing concerns about the specifics of note exchange and deposit figures, even the RBI Governor has stated that reconciling the data was challenging due to overlap in reporting.

The withdrawal of the `2000 may have certain impact on cash-based businesses like high-value real estate transactions, gems and jewellery, MSME and other informal sectors. These businesses are likely to face cash shortages and could also face problems in accepting cash payments.

Despite the assurance and explanation by the RBI that the withdrawal of `2000 note is a move towards the “clean note policy”, such recurring repeal of banknotes might pose certain uncertainty in banking systems and particularly in currencies of higher denominations. A better policy option might be to come out towards a future roadmap in a clear manner to maintain confidence on currencies and the banking system, that will also be consistent with India’s objective of obtaining $5 trillion economy.

Despite the assurance and explanation by the RBI that the withdrawal of `2000 note is a move towards the “clean note policy”, such recurring repeal of banknotes might pose certain uncertainty in banking systems and particularly in currencies of higher denominations. A better policy option might be to come out towards a future roadmap in a clear manner to maintain confidence on currencies and the banking system, that will also be consistent with India’s objective of obtaining $5 trillion economy.

For instance, Japan is a $4.4 trillion economy, at the same time, Japan is heavily-cash based economy. With digital payments accounting for around 36 percent of the private consumption expenditure in 2022, cash is still considered king in the country. Nevertheless, a Nikkei report indicates citing data from the Bank of Japan, the Japan Consumer Credit Association, and the Payments Japan Association, that cashless purchases hit 111 trillion yen ($838 billion U.S.) in 2022. There are many countries exploring Central Bank Digital Currency (CBDC) and India has also started on a pilot basis. With an objective of $5 trillion economy, at the same time with a substantial MSME sector heavily dependent on cash transactions we need a balancing act, hence a need for sequential movement, with a clarity of approaching the path towards $5 trillion economy.

According to a column by Amit Kapoor, in ET (27 April 2022) “In India, 99.7% of the enterprises are in the unorganized sector, of which two-thirds do not have registration anywhere. A significant fraction of these unorganized firms falls in the “micro” category of the MSME sector comprising owner-managed firms, most of which operate with less than five workers.” Despite witnessing rapid economic growth over the last two decades, 90% of workers in India have remained informally employed, producing about half of Gross Domestic Product (GDP).

Further, according to an analysis by the Azim Premji University titled “State Of Working India 2021 – One Year of Covid-19”, highlighted that 34.1% of those who were permanently salaried employees in 2019 were self-employed in 2020 owing to the pandemic and 9.8% of permanently salaried employees became casual or daily wage workers. This article has also provided details about that actually means as unorganised sectors, and their contribution to the GDP. Also, an article New Indian Express titled as “What is it that ails our informal sector?”(May 2020) has highlighted that “Let us dissect the problems of the informal sector. They effectively constitute 90% of the workforce and about 50% of the national product. As per Government of India statistics, the unorganised sector contributes almost 50% of the total GDP.”

Further, according to an analysis by the Azim Premji University titled “State Of Working India 2021 – One Year of Covid-19”, highlighted that 34.1% of those who were permanently salaried employees in 2019 were self-employed in 2020 owing to the pandemic and 9.8% of permanently salaried employees became casual or daily wage workers. This article has also provided details about that actually means as unorganised sectors, and their contribution to the GDP. Also, an article New Indian Express titled as “What is it that ails our informal sector?”(May 2020) has highlighted that “Let us dissect the problems of the informal sector. They effectively constitute 90% of the workforce and about 50% of the national product. As per Government of India statistics, the unorganised sector contributes almost 50% of the total GDP.”

The need of the hour is clearly towards understanding that cash will continue to dominate, or at least drive a considerable part of the economy. And, that giving greater credibility and reliability to currency notes is sacrosanct. The more transparent a roadmap we create, better we build a resilient eco-system as we move towards our goal of a 5 trillion economy.

– Editor.

ABOUT THE AUTHOR

Vipin Malik, Chairman, Infomerics Ratings, served on Boards of Reserve Bank of India and Bharatiya Reserve Bank Note Mudran Private Limited, Canara Bank, J&K Bank, etc. Author of several well-received books and several articles. He appears often on television debates on economy issues.

Vipin Malik, Chairman, Infomerics Ratings, served on Boards of Reserve Bank of India and Bharatiya Reserve Bank Note Mudran Private Limited, Canara Bank, J&K Bank, etc. Author of several well-received books and several articles. He appears often on television debates on economy issues.