A double whammy has fallen on the doorsteps of the travel and tourism sector. While for months, the sector has continued to look for help from government, to mitigate the stress, here comes a shocker of unprecedented magnitude. LTC provisions can now be diverted to other spends, subject to certain conditions. Tax payers can spend buying ACs and refrigerators and do not need to travel. It is virtually saying no need to discover your country immediately; this can wait, and buy your daily consumer needs instead.

WTTC India has appealed to the Hon’ble Prime Minister, Narendra Modi, Hon’ble Finance Minister, Nirmala Sitharaman, Hon’ble Minister for Civil Aviation, Hardeep Singh Puri and Hon’ble Minister for Tourism, Prahlad Singh Patel on behalf of India’s Travel & Tourism Sector that the government’s recent decision to recast the Leave Travel Allowance (LTA) scheme to a Cash Voucher scheme, which, expects to generate a temporary additional consumer demand of Rs 28000 crores is detrimental for spurring demand for India’s already stressed Travel & Tourism Sector.

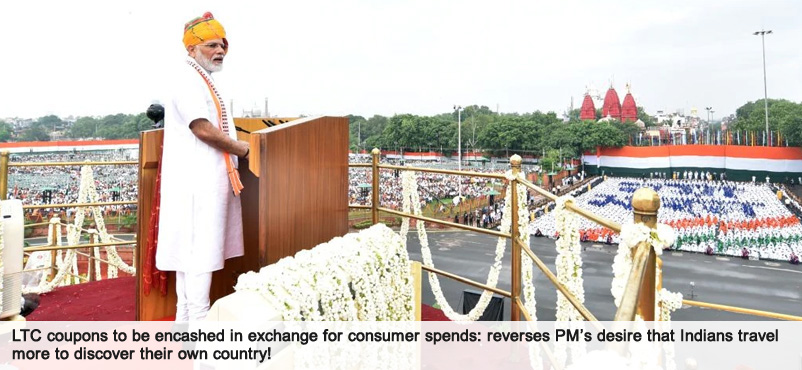

WTTC India has stressed that this decision goes against the principle of Ministry of Tourism, Government of India’s premier program of “Dekho Apna Desh” and against the vision of the Hon’ble Prime Minister, who from the ramparts of the Red Fort, only as recently as on 15 August 2019 had announced the foundation of this scheme by saying,

“I know people travel abroad for holidays, but can we think of visiting at least 15 tourist destinations across India before 2022.”

According to the NSO data released for the April-June quarter of 2020-21, the services sector, accounting for nearly 60% of the economy, slumped 20.6% in the June quarter, compared to a 4.4% growth in the previous. Domains like hotels, restaurants, hospitality and airlines, have borne the maximum brunt. Trade, hotels, transport and communications sector posted the second highest contraction, declining 47% in the June quarter. The quarter of July-September 2020 will be nothing better.

Even with the Unlock in phases, the demand in travel and tourism is still showing no signs of growth. Airlines flew 39.43 lakh domestic air passengers in September 2020 which is 66% lower than last year as submitted by DGCA. Industry estimates show Hotels are likely to see only 30% occupancy till the start of 2021, as compared to an occupancy of 65% last year. Demand for travel packages are near sub normal levels. Restaurants are unlikely to see pre-covid level footfalls and revenue in times to come.

The latest projections for India for total Travel & Tourism in terms of Jobs and GDP losses for 2020 from WTTC projects a grim picture:

|

Total T&T jobs(in 000s) – India |

2019 total T&T jobs (in 000s) 39,822 |

Downside 2020 loss -23,678 |

|

Total T&T GDP ($bn) – India |

2019 total T&T GDP ($ bn) 194.3 |

Downside 2020 loss -119.2 |

Added to this are negative travel advisories for travel to India from all its major source markets (e.g. the latest advisory from UK affecting charters to Goa) points to a distant recovery for India’s Travel & Tourism Industry.

Travel & Tourism has multisectoral linkages and spend in travel & tourism induces spend in primary sectors, such as Agriculture, Manufacturing, Construction, Oil & Gas etc. According to a 2018 report by Google and Bain & Co, Indians took 182 crore domestic and international trips in 2018, spending upwards of Rs 6.5 lakh crores, which is equivalent to about 3.5% of gross domestic product. Provisional estimates from Ministry of Tourism show that just between January to March 2020, i.e. in the pre-pandemic period of 2020, India earned Rs 44203 Crores in Foreign Exchange from international tourist arrivals. The potential of travel & tourism for India is underlined in these above data sets.

Proper encouragement of the LTC Scheme by both the public and private sector would have generated more demand across verticals, collections of GST, contribution to GDP and most importantly sustain jobs.

To generate demand in the economy and help the already stressed Travel & Tourism sector, WTTC-II urges the Government with a view on the revenue contributions by the Travel & Tourism Sector:

Reconsider the recast of the LTA scheme and incentivize travel by introducing a 100% tax reduction/rebate in Income Tax for Indian citizens spending on Domestic Travel to a cap of Rs 75,000 and Rs 25,000 towards restaurant spend per tax payer. Similar extensions should also be extended to MICE/Business Event spends by Indian Corporates/Businesses and individual spends on Weddings. This will spur multisectoral demand for India’s economy and energize GST collections.

Open Travel Bubbles/Agreements and Air Charter facilities between key destinations in India and our key Source Markets by removing restrictions of Visa and with aggressive bilateral agreements and focussed publicity to boost revenue collections from international tourist arrivals.