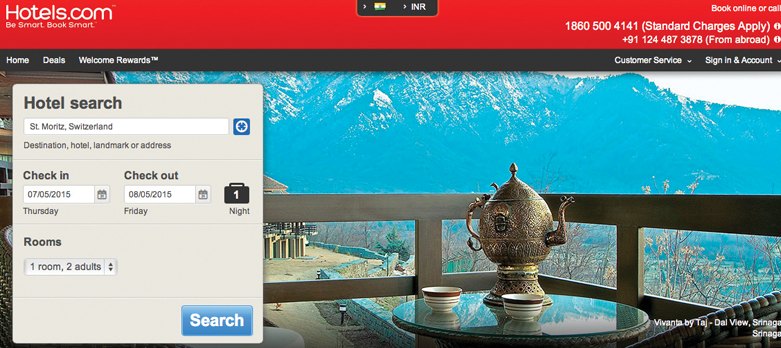

For the global hospitality industry, this challenge is uniform – geography agnostic and also brand and segment agnostic to a large extent. The dimension of the issue varies at this juncture and presently it is more pre-dominant in developed markets but in emerging markets like India where the hospitality business is on a growing curve, the impact of this trend is expected to be felt sooner rather than later.  The growing dominance of OTAs (Online Travel Agencies selling hotel rooms) best represented by companies like Expedia, Hotels.com, Booking.com, Orbitz and their hundreds of clones all across the world ensure that hotel units stay more visible for the customers. But the equation between them and the hotel industry could hardly be called harmonious today. What had begun as friendly external sales assistance system for hotels in early 90’s has gradually turned into the major sales channel making these OTAs so powerful that at many places they have been accused of indulging in arm-twisting to extract hefty commissions. “They are eating into our business,” is the common grudge which hoteliers spell out today and the ‘bromance’ of the early days has now given way to the ‘frienemy’ tag.

The growing dominance of OTAs (Online Travel Agencies selling hotel rooms) best represented by companies like Expedia, Hotels.com, Booking.com, Orbitz and their hundreds of clones all across the world ensure that hotel units stay more visible for the customers. But the equation between them and the hotel industry could hardly be called harmonious today. What had begun as friendly external sales assistance system for hotels in early 90’s has gradually turned into the major sales channel making these OTAs so powerful that at many places they have been accused of indulging in arm-twisting to extract hefty commissions. “They are eating into our business,” is the common grudge which hoteliers spell out today and the ‘bromance’ of the early days has now given way to the ‘frienemy’ tag.

A formidable force in developed markets

In the developed markets in the world, OTAs have already turned into a gigantic force and there are enough statistics to endorse this assumption. According to a study, OTAs account for nearly 50 percent of the hotel room booking in the matured markets. In the US alone, the online travel agency business (across all spectrums) accounted for an annual business of $170 billion last year, out of which $4 billion to $8 billion was paid as commission to OTAs for hotel bookings – not merely rooms but ancillary services too. An online agent like Expedia today has in its kitty a staggering 4,35,000 hotels which it can offer to customers anytime, anywhere. Booking.com, owned by Priceline, claims to have over 540,000 properties globally under contract and that it ensures a whopping 700,000 room nights reservations per day. The numbers itself underline the kind of might these sales channels are wielding today.

Global observers cite a host of reasons for the monolithic stature which some of the front ranking companies in the online hotel sales space have assumed. With the volcanic growth in the internet space in the last two decades, these platforms have registered a tremendous horizontal growth. An offshoot of the e-commerce segment, their popularity stems not only from offering enormous choices to the customers but also deep discounts, comparisons between the units in a location and be easily accessible round the clock. In the initial phase of their growth, hoteliers especially in the mid-scale segment and down below had looked at them quite favourably considering them a supplementary sales channel. Over a period of time, hotel companies themselves have opened up their own online sales platforms. However, OTA’s growth has far outpaced the online initiatives undertaken by the hotels and its primarily because their ability to offer comparisons and also deep discounts. It is these deliverables which have given them a decisive edge making them not only an indispensable but also a very powerful force now. “OTAs are here to stay. People perceive they are delivering quality services and good deals. And consumers love a good deal. A strong opinion within the hotel fraternity is we need to work with them more positively,” opined Rakesh Sarna, MD, Taj Hotels at the recently held HICSA convention in Delhi while discussing the issue of technological disruptions for the hotel business which are emerging on the scene. In the same session, Arne Sorenson, President & CEO, Marriott International strongly advised fellow hoteliers not to have a cavalier attitude on this issue even as he asserted that hotel units have an open area to score where OTAs can’t step in. “We can effectively promote our own online channels. And more importantly, we can control stay and experience of the customer.”

A global hospitality major like Marriott can probably afford to talk of putting in painstaking efforts to promote its own sales channel and then retain customer’s loyalty with high services standards. But this certainly is not an option for players down the rung. Even in a vibrant hospitality hotspot like Dubai, the issue is gaining prominence compelling the authorities to stipulate new provisions. “It is no secret to anybody that OTAs often indulge in some clever hardselling. That is why Dubai has now introduced licenses for hotel room trade regulation,” said Gerald Lawless, President & Group CEO of Jumeirah Group.

According to an IT industry analyst, OTAs have already penetrated deep into the booking space of hotel units globally and their ratio of hotel room sales is quite high for the mid-segment units and properties in the star I and star II categories. Even for the noted global brands, their contribution is believed to be in the 15-30 percent range of total room sales. And this certainly is not a small number. As if this was not enough, OTAs are slated to further consolidate their position vis-à-vis big brands in not so distant future. Devising their own loyalty programmes (like all major hotel groups) which are littered with a range of offerings, they are expected to create an option for even the loyal customers of the big brands. And this is expected to generate more heartburn in the marketplace.

How the scene is panning out in India?

In the Indian market place, the issue is yet to reach to the pinching proportion resulting in swords drawn on both sides. No doubt, the explosive growth of the e-commerce business in the country is often believed to have been triggered by the airline and railways bookings before expanding its ambit to cover general merchandise, online hotel room booking has not been in the forefront of this drive. According to an industry estimate, online bookings account for only 11 percent of hotel room inventory that is sold in the country, with direct booking having a hefty share of 76 percent and offline agents filling 13 percent of the room inventory. But all this is slated to change now. A recently released report by Google India clearly earmarks that online hotel sales is at the cusp of a major growth – in just next one year, the pie is expected to grow by a staggering $1 billion. The total annual online hotel sales which had stood at $0.8 billion at the end of the last year in India is projected to jump to $1.8 billion in 2016. “Our research clearly points out that the online hotel sales segment has now taken off in a big way in India. And it will exponentially grow given the strong surge in internet penetration and the growing popularity of smartphones,” Vikas Agnihotri, Industry Director, Google India said.

In Indian context, these are clearly the early hours for online penetration in the hotel booking segment and even as scores of OTAs have already positioned themselves in the segment (for most of them it is an additional vertical where the growth potential is quite high), some distant murmuring notes can still be heard. “For past couple of years, we have seen the online percentage of our room inventory sales has consistently grown and the players in the fray have begun to be more demanding in terms of their commission. As this channel become more robust, such issues are bound to surface like anywhere else,” IT head of a major mid-segment group, who did not wish to be named, told TourismFirst. Deepak Tuli, COO of Goibibo, however, says that hotel-OTAs equation so far has stayed away from any acrimony. “Goibibo presently has around 18,000 contracted hotel units in the country and by and large we have existed as understanding partners. The hotel units especially in tier-I and tier-II locations are quite happy that they are now also represented by robust platforms like us,” he said.

Hari Nayar, founder of HolidayIQ (playing the role of aggregators’ aggregator offering rooms in nearly 50,000 hotels in the country today), too endorses Tuli’s assertion of harmonious existence. “In a geographically diverse country like ours which is dotted with thousands of hotel units, OTAs rising interest in online sales of hotel rooms is a good news. They have begun contributing robustly to make hotels visible in the online space. Though there have been instances, where price parity has become an issue but everybody is involved in building scales right now,” Nayar pointed out. Price Parity meaning the same price point across all online and offline sales channels has been a major bone of contention in the matured markets with OTAs asking for deepest possible discounts, much cheaper than any other platform. Nayar further confirms the assumption that the bedrock of the growth of OTAs in India (selling hotel rooms) is small hotel units. “Small hotel units which are in the far-flung areas are particularly keen to get on the board. They can’t spend so much on branding and their own online platforms can never get the required traction. These units are happy to pay commission in the range of 10-30 percent. Additionally, some OTAs have even begun bulk inventory buyout in the peak season where commission formula does not apply. The point is: new dimensions are being added to the equations between OTAs and hotel companies here. The day of the game for one-upmanship is far off,” Nayar underlined.

The possible new dimensions

While it will take quite a while before a typical OTAs vs hotel groups battleline can be drawn in the Indian marketplace, there are some interesting dimensions which have begun taking shape globally which signal possible integration between the two sides and a more closer collaboration. In a significant recent development, Accor acquired Fastbooking, a noted digital services provider which has 4000 hotel clients. This is incidentally Accor’s second major acquisition in the recent past in the digital services space- the first being its controlling purchase of Wipolo last October. Hospitality industry veterans are predicting more such moves to be initiated in the near future. Joining hands strategy may also find reflection in the Indian market. At HICSA convention, Patu Keswani, CMD, Lemon Tree confirmed that his company is toying with the idea of funding an OTA. “Lemon Tree is looking at providing financial assistance to a start-up OTA. And we may do it quite opportunistically. Our decision will be guided by our understanding that online hotel booking segment in India today is in the same position as online airline booking segment was ten years ago,” he said.

However, the much larger tectonic shift which seems to be on the anvil is the possible rise of metasearch sites like Kayak and Bing. These sites (aggregators’ aggregator) will not only allow travellers to compare prices across hotels but also across OTAs. “Metasearch engines will further galvanise the online hotel booking segment and may give stiff competition to the OTAs,” says a hotelier.

By Ritwik Sinha