Indian carriers expected to place orders for 1500-1700 aircraft over the next 24+ months.

India: The next growth engine of global aviation

The Indian market in the post-COVID era is attracting global attention as arguably the most promising aviation market. Traffic recovery has been amongst the strongest in the world; the airline market is now 100% privately-operated following the divestment of Air India; the development of airport infrastructure is continuing and apace; and economic regulation is maturing. India has long shown promise, but has struggled to realise its potential. It may finally be set to take its place as the global aviation market of the 21st century.

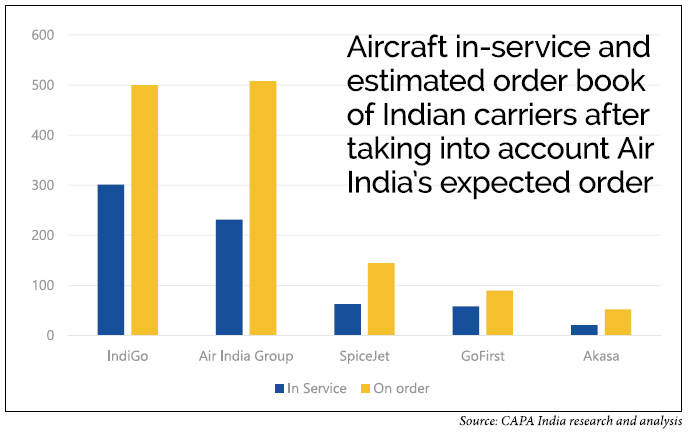

But as of today, the market remains highly under-penetrated. The total commercial Indian fleet of around 700 aircraft is smaller than some of the world’s largest individual airlines. Given the immense potential that exists, it stands to reason that there is a need to induct more aircraft.

Based on CAPA India’s proprietary traffic forecasts for the next decade and beyond, combined with our assessment of aircraft retirement cycles, we expect that Indian carriers will place orders for around 1500-1700 aircraft over the next 12-24+ months.

Air India is expected to make the first move, with reports that it will shortly place a historic order for close to 500 aircraft, marking a genuine turning point in Indian aviation

Air India has been widely reported to be about to place an order for close to 500 aircraft, split between Airbus and Boeing. It could end up being the largest order in global aviation history, in terms of both the number and value of aircraft, which are expected to include a mix from the A320neo and 737 MAX families, as well as widebody equipment.

The order would come soon after the first anniversary of the acquisition of Air India by Tata Group, following the privatisation of the national carrier. An order of this magnitude could simply not have been contemplated under public ownership. It therefore stands testament to how the divestment of Air India has strategically and positively re-set the aviation industry in India, positioning it to realise its potential. A new aviation order is likely, whose impact will be felt globally.

The aircraft order is a critically important milestone. However, to turnaround Air India will be a 3-5 year mission. Nevertheless, the promoters, Tata Sons, and in due course Singapore Airlines, have the long-term vision, strategic purpose and commitment, and patient capital to enable a new Air India to emerge.

And although the order is expected to be of record proportions, it is to a large extent making up for the growth deficit that Air India has experienced for the last decade and more. After taking into account the replacement cycle for incumbent aircraft, and the tremendous growth potential of the market, Air India will undoubtedly have to commit to more orders, sooner rather than later.

Indian carriers currently have just under 800 aircraft on order of which IndiGo accounts for 500, which would increase to close to 1300 if the Air India order materialises as expected.

Indian carriers are thereafter expected to place orders for a further 1000-1200 aircraft, starting off with another large order from IndiGo. What was envisaged to be a 300 aircraft order prior to COVID, may now increase to 500.

Almost every carrier in India is expected to order more aircraft in the next couple of years, for fleet replacement as well as growth, given that the order book for most incumbent carriers could be considered conservative relative to the growth potential of the market over the next decade and beyond.

IndiGo had been planning to place a significant order of around 300 aircraft prior to COVID, which was deferred due to the pandemic. This is now likely to proceed, and could be even larger than previously envisaged, increasing to around 500 aircraft now.

In recent months there have been numerous cases of aircraft deliveries being delayed where the airframe was ready, but engines were not available due to supply chain issues. The incidence of such cases is expected to ease by the end of FY2024.

However, even once supply-side challenges are resolved, aircraft and engine OEMs face a very significant backlog of orders that could take years to address. Airbus and Boeing combined had 12,669 unfulfilled orders as at 31 Dec 2022. Delivery slots are very hard to come by for at least the next couple of years, while for narrowbodies the situation is reportedly tight until 2029.

In order to secure timely delivery slots to support their growth plans, Indian carriers such as Akasa and Go First will need to place scale bets by entering into new orders with a sense of urgency. SpiceJet will need to actualise its current order and prepare for further expansion. And even Air India, as mentioned, will need to place another large order relatively soon.

Due to the pressure of orders relative to production challenges resulting from supply chain and other issues, the pricing that can be negotiated may not be as attractive as it has been in the past, especially from engine OEMs. Indian carriers may find that the costs of aircraft and engine acquisition, as well as after-market services may be higher than expected.

The Air India order is expected to mark the beginning of a much-needed focus on widebody equipment

Reports indicate that the Air India order could include 70 widebodies. This would mark the beginning of a much-needed focus by Indian carriers on long haul operations.

Indian carriers today operate less than 50 widebody aircraft, an insignificant number for such a significant market. In contrast, Emirates alone has a fleet of over 260 widebodies.

Other Indian carriers, such as IndiGo, may consider inducting twin-aisle equipment (beyond the three widebodies that IndiGo has wet-leased).

Expansion on this scale will require institutional transformation

Ordering aircraft is arguably a relatively easier task. Far more challenging is to prepare the entire aviation eco-system to be able to absorb those aircraft. Aside from aircraft that are being ordered, growth is also expected to come from increased leasing of equipment, especially in FY2024.

The industry should not be caught off-guard by the influx of capacity, as happened in FY2006-FY2008 when aircraft were grounded due to a shortage of crew, or during FY2015-FY2019 when sustained year-on-year growth of close to 20%, challenged the entire aviation system.

As these mega-orders are progressively announced, the institutional framework required to enable this massive step-change will become all the more critical. There will be a need to align policy, regulation, availability of skills, knowledge development, infrastructure (which includes airports as well as airspace), competition and consumer interests, with global best practices, while delivering an industry that is safe, secure and sustainable. This must be supported by the removal of the negative fiscal regime, comprising direct and indirect taxes.

Other institutional requirements remain work-in-progress, such as the emerging shortage of technical manpower (pilots, AMEs, technicians, air traffic controllers and technocrats for the DGCA, BCAS and the CISF), which will assume ever more critical importance.

Preparing for the pace of growth that is expected is critically important. India is, perhaps, on the cusp of a long-awaited and historic change. The Ministry of Civil Aviation is already taking steps in line with this, with positive developments visible in all key areas, but a step-change is required across the industry.

But if all key stakeholders are aligned in their mission, India is well-poised for long-term renewal,

There are several positive developments in progress that bode well for the sector. For example:

- Consolidation in the airline sector is likely to result in more rational pricing;

- The investment that is coming into the industry is now increasingly profit-driven;

- The large-scale fleet renewal that is underway will bring down both fuel and maintenance costs.

- Taxation on fuel has also been coming down as a result of most states having significantly rationalised VAT on aviation turbine fuel, largely due to the persistent efforts of the Honourable Minister of Civil Aviation, Shri Jyotiraditya Scindia. However, 7-8 large states, that account for the majority of traffic still continue to hold out.

- And there is sufficient capacity at the key airports to support growth for the medium term.

- To take advantage of these favourable conditions, airlines must focus on:

- enhancing their productivity, especially aircraft and crew utilisation;

- and offering cost-plus pricing and generating ancillaries to maximise revenue;

Meanwhile, the Ministry of Civil Aviation should continue to work on convincing the remaining large states to rationalise VAT on aviation turbine fuel, while at the same time continuing to work to bring down other direct and indirect taxes.

The continuing impact of COVID on airline balance sheets is likely to persist for much longer than expected. But with all stakeholders working together with a common purpose and mission, long-term structural renewal is possible, and likely.

ABOUT CAPA INDIA

CAPA India was established more than 19 years ago with a mission to become a leader in global aviation knowledge. We have since built a worldwide portfolio of clients and experience, and an enviable reputation for independence, insight and integrity. Today aviation businesses around the world turn to us for sound advice and research.

CAPA India was established more than 19 years ago with a mission to become a leader in global aviation knowledge. We have since built a worldwide portfolio of clients and experience, and an enviable reputation for independence, insight and integrity. Today aviation businesses around the world turn to us for sound advice and research.