HVS has released its annual review for the hospitality industry for the year 2019. Much of it, unfortunately, relates to a period before the COVID-19 set in, bringing its wrath upon the hospitality industry. It still makes important reading as this was the forecast for 2020 before the disaster struck.

Introduction

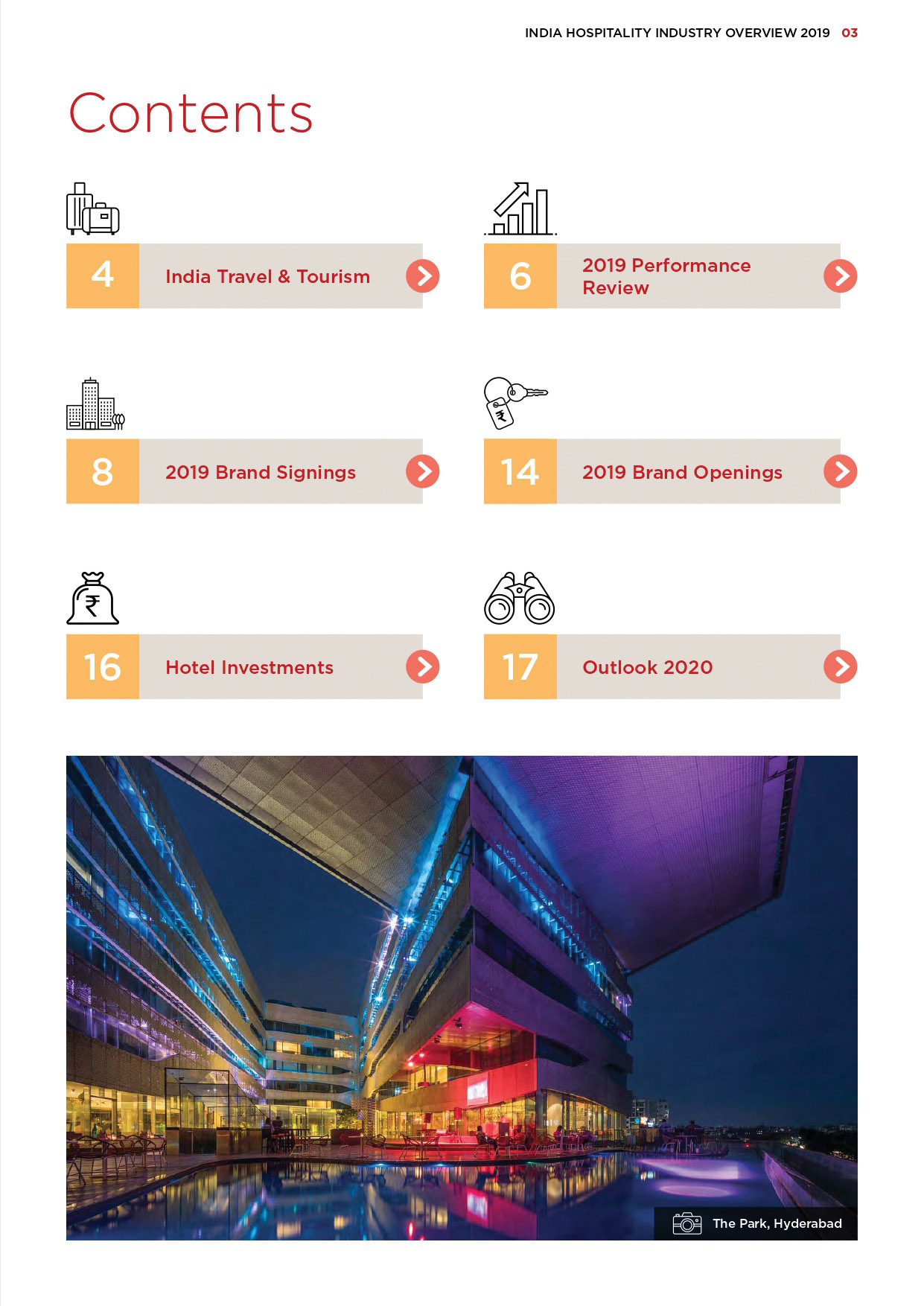

2019 has been a mixed bag for the sector. The year started on a positive note, with the first quarter of the year performing in line with market expectations, and in later part of the year, the sector benefited from easing of Goods & Services Tax (GST) rate on hotel room tariffs across the board. But successive negative impacts on the sector drained much of the enthuse. The closure of Jet Airways, India’s largest airline by market share, lead to a severe crunch in availability of airline seats, which combined with the impact of general elections in the country led to a temporary softening in demand growth. As the year drew to a close, the industry witnessed record-breaking performance in November, with several hotels in major markets proclaiming it to be their ‘best- ever to date’. However, the hardening economic headwinds and protests related to CAA & NRC dampened the spirits towards the end of the year.

The Indian hotel industry witnessed an India- wide RevPAR growth of just over 4% in 2019, a year in which the sector underwent several ups and downs. The industry’s performance even after 12 years is 28% lower in RevPAR from the last peak of 2007.

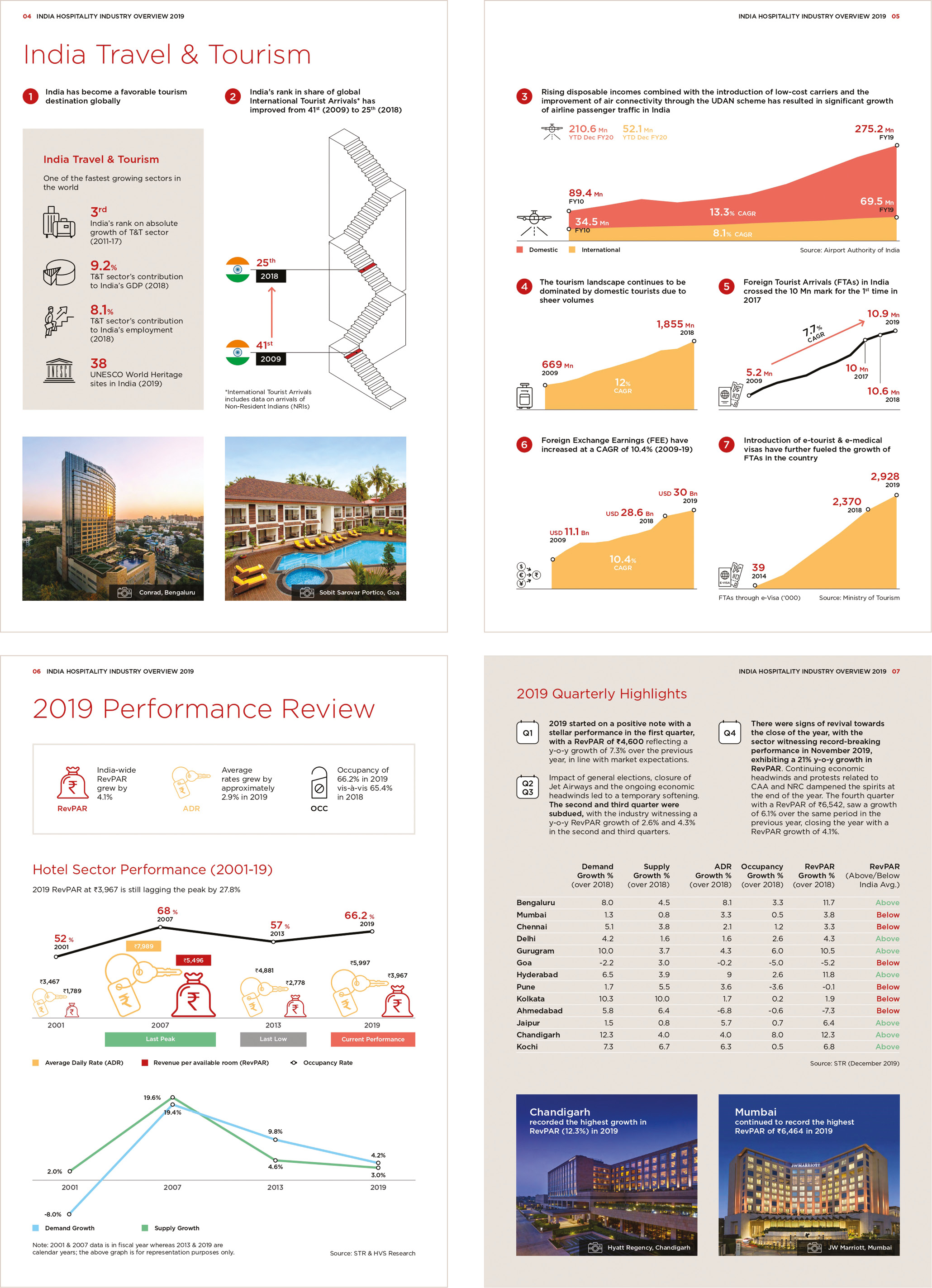

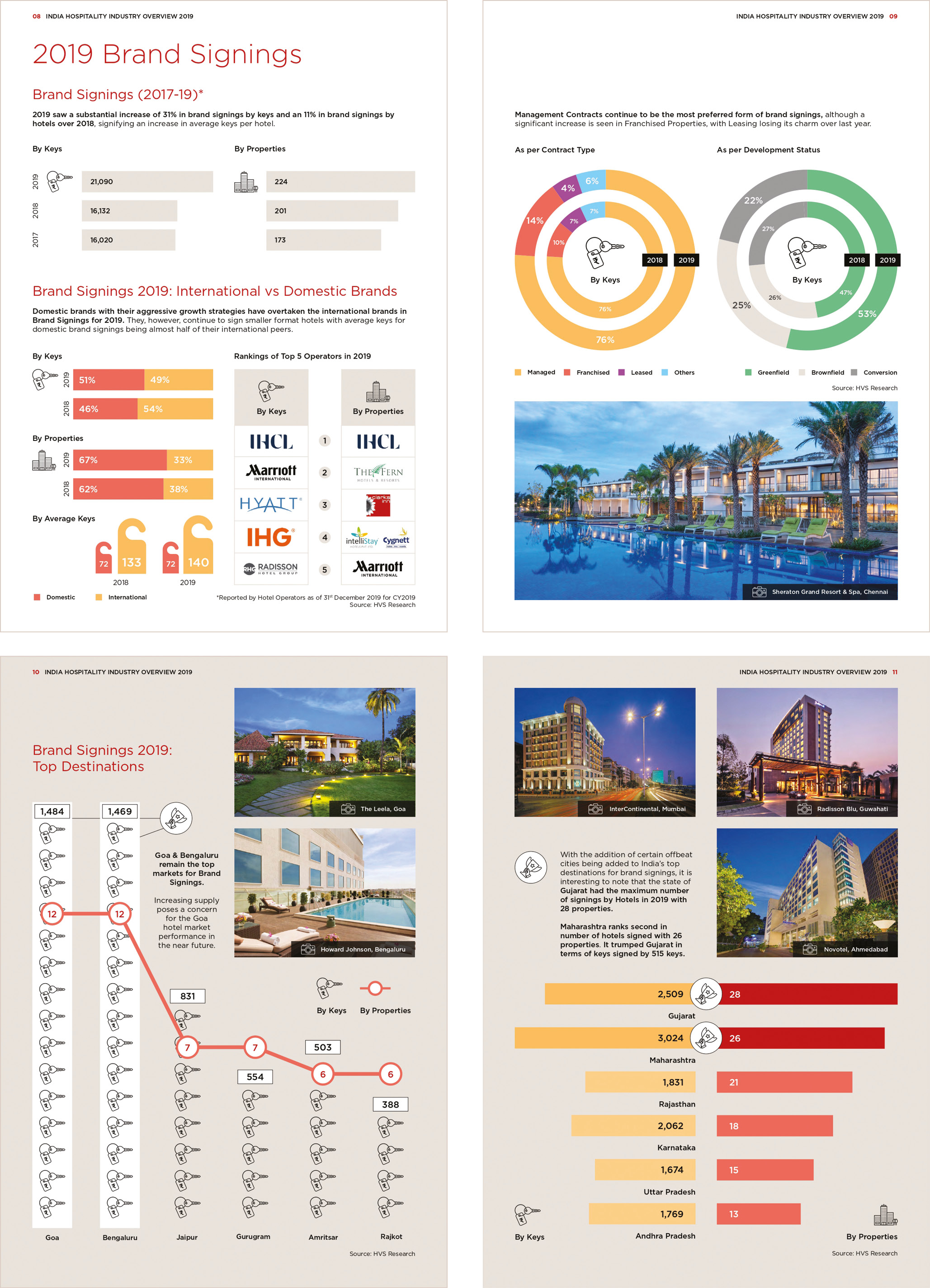

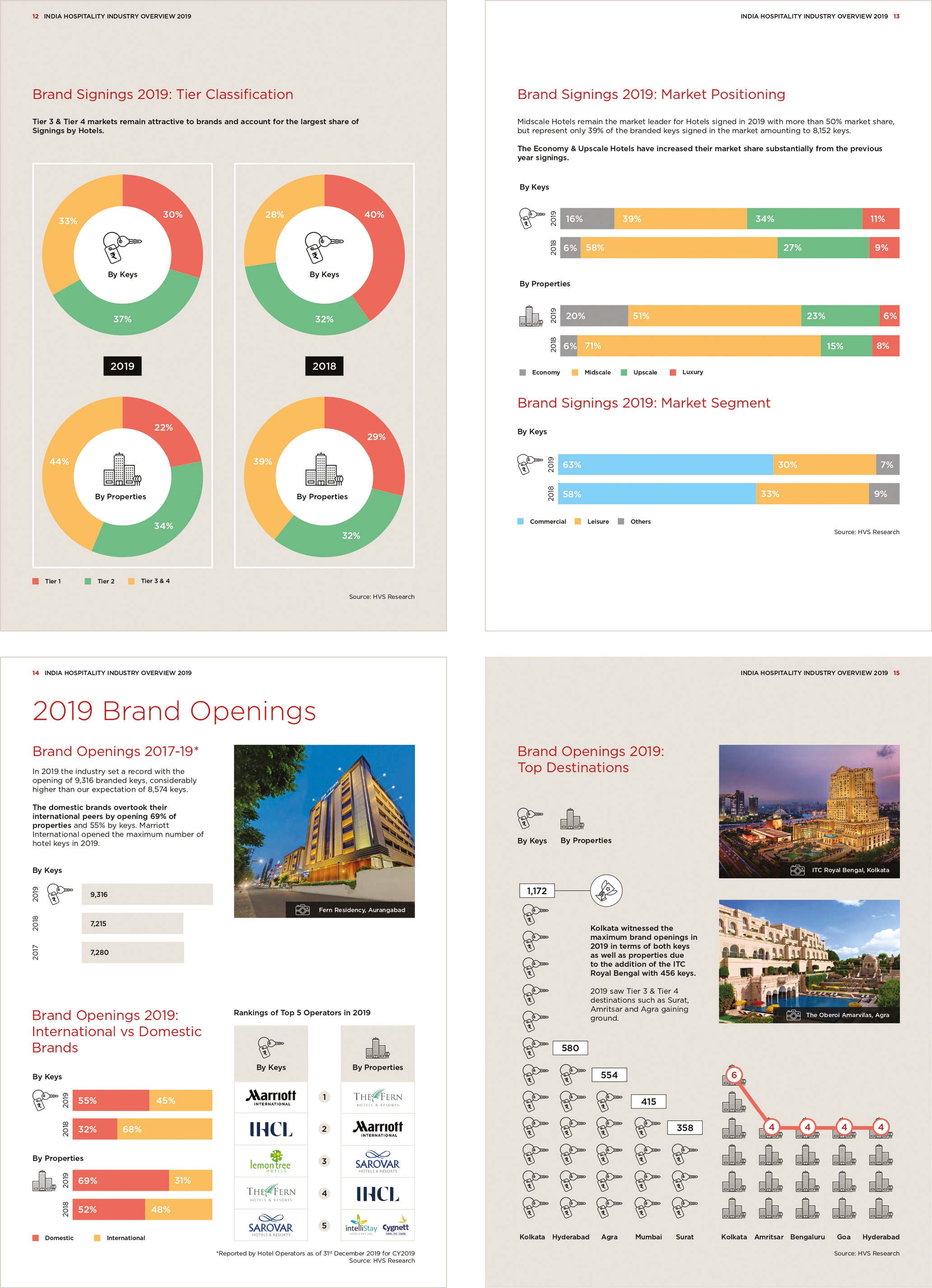

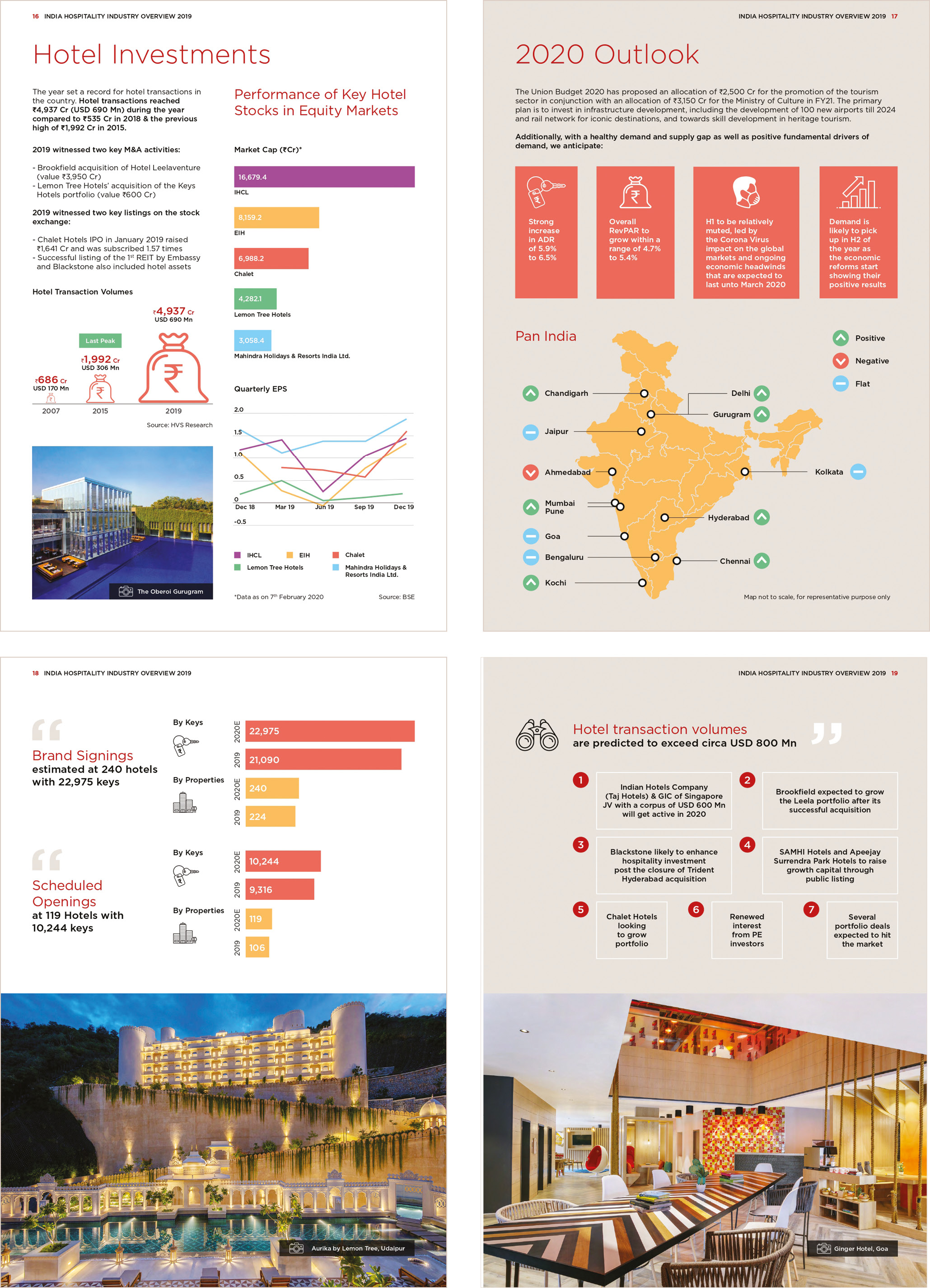

The sector witnessed over 31% growth in brand signings during the year with approximately 171 new hotels entering the branded hotel market and an additional 53 being re-branded. Tier 3 & 4 cities continue to show aggressive growth as brands try to spread their distribution based on a steadily improving demand from these cities. 2019 was a remarkable year for hotel transactions, which witnessed transactions worth `4,937 Cr compared to just over `535 Cr in the previous year.

In 2020, we anticipate the sector to perform at similar levels of growth as witnessed in 2019, with overall RevPAR growing within a range of 4.7% – 5.4% over 2019. The first half of the year will be relatively muted, led by the Corona Virus impact on the global markets and ongoing economic headwinds that are expected to last unto March 2020. Demand is likely to pick up in the second half as the economic reforms start showing their positive results. The successful closure of big-ticket deals has improved market sentiments and have paved the way for more Mergers & Acquisitions in 2020, which we believe will exceed USD 800 Mn.