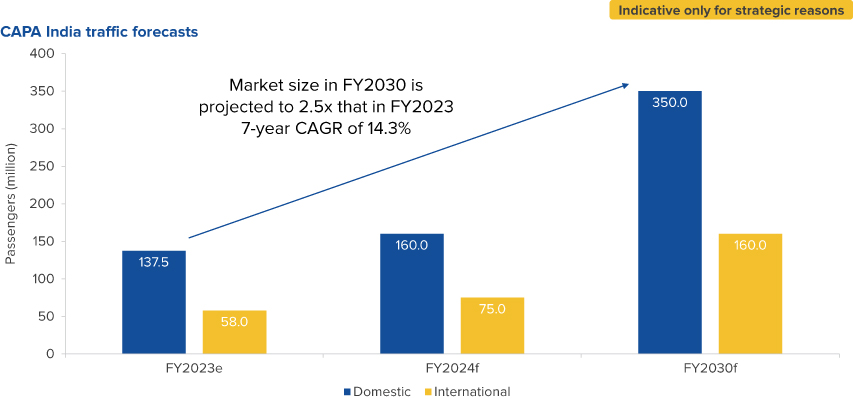

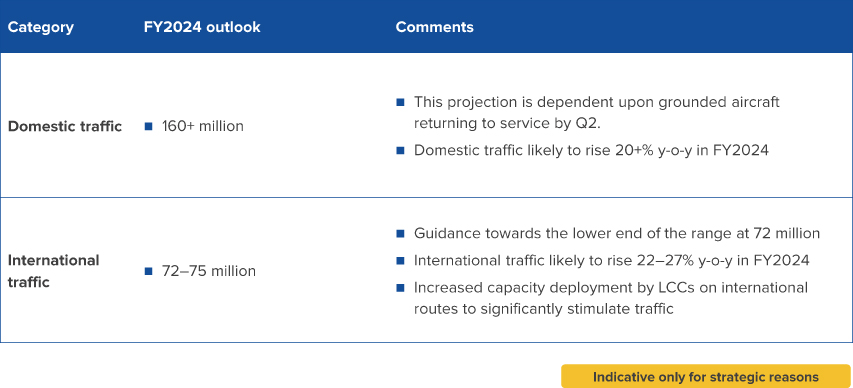

CAPA India in its comprehensive report on India Aviation Outlook FY2024 expects domestic and international traffic to be in the range of 160+ million and 72-75 million in FY2024, respectively, with both increasing by 20% or more y-o-y.

Looking at the entire eco-system of Indian aviation: Minister Scindia

Looking at the entire eco-system of Indian aviation: Minister Scindia

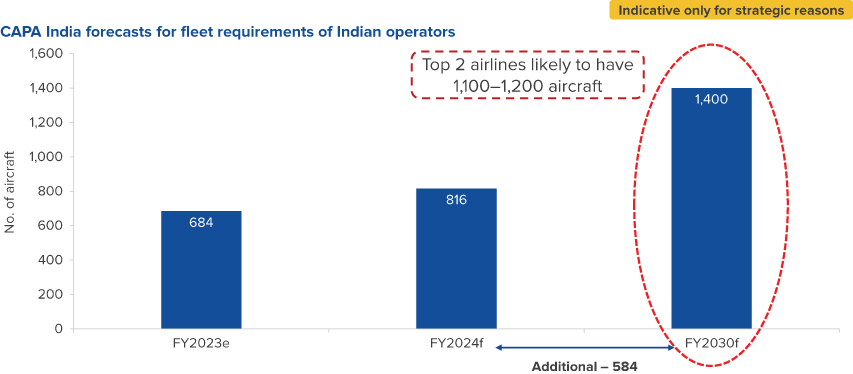

Indian carriers are together projected to have a fleet of around 2,000 aircraft in the next five to seven years from a present estimate of 700 planes. Looking at across the eco-system, Scindia emphasised augmentation of human resources in the country, with institutes like the Airports Economic Regulatory Authority (AERA) and DGCA (Directorate General of Civil Aviation) taking upon them an additional 10 and 400 personnel, respectively. Air traffic controllers may see a growth to around 3,600 personnel. Some 15 flying training organisations are expected to be set up by the end of this year, taking their total number to 50.

Looking at numbers, he pointed out India’s civil aviation sector sustained and robust demand, having seen an almost V-shaped recovery from an all-time low during the pandemic. The country at present continues to record a daily passenger traffic of 4.2 lakh to 4.4 lakh, optimistic that in the busy season this October onwards, the sector could break previous records.

India could become top aviation market globally by decade-end: Civil Aviation Secretary Bansal

India could emerge as the top aviation market globally by the turn of the decade, surpassing the United States and China on most parameters, Civil Aviation Secretary Rajiv Bansal said Tuesday. India is currently the world’s third-largest civil aviation market and has big ambitions to expand air connectivity, which is still beyond the reach of a significant chunk of the population.

India could emerge as the top aviation market globally by the turn of the decade, surpassing the United States and China on most parameters, Civil Aviation Secretary Rajiv Bansal said Tuesday. India is currently the world’s third-largest civil aviation market and has big ambitions to expand air connectivity, which is still beyond the reach of a significant chunk of the population.

Bansal said that with the rising demand for air travel in India, a significant push in aviation infrastructure is also being seen. Passenger handling capacity at airports at the country’s six major metropolitan cities is likely to expand to 320 million per year in the near future and to 500 million per year over the next few years, he said. The government wants all six metros – Delhi, Mumbai, Bengaluru, Hyderabad, Chennai, and Kolkata – to emerge as major international hubs for air travel.

Even as India’s aviation sector registers growth on most fronts, Bansal said that he sees three challenges ahead. We need to work towards building world-class aviation infrastructure “ahead of the curve” and not behind it, inability of global aircraft and engine manufacturers to keep up with India’s rapidly rising demand for planes and components, and the present inadequate MRO facilities of significant scale within India.

Key Learnings from FY2023

- N After two years of unprecedented financial devastation, two key strategic highlights emerged in FY2023:

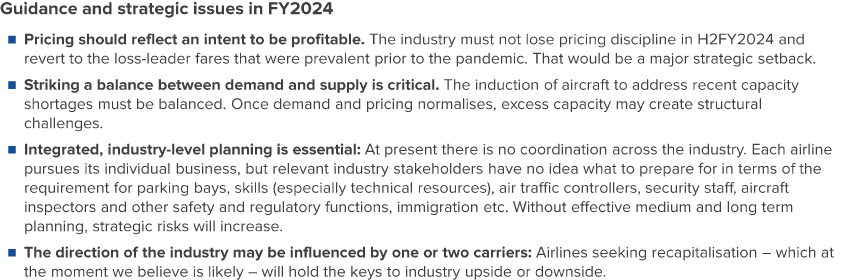

- Airline pricing was set with profitability in mind – this was particularly visible in 3QFY2023, although costs impacted profitability. This was driven by: 1) fare caps and 2) the fact that airlines had incurred such large losses that they had no alternative but to strive to be profitable. The intent and determination to maintain pricing discipline was clear.

- Passengers adjusted their expectations of fares. There was a recognition that travel would be more expensive than it had been, and they were by and large willing to pay that premium.

- N These twin phenomena had remained elusive for the last 20 years.

- N Capacity shortages contributed to this scenario. As capacity growth resumes in FY2024, yields are expected to dilute, but there has been a re-set of fares that airlines have the ability to make more permanent.

- N The Ministry of Civil Aviation’s determined efforts to encourage states to reduce VAT on ATF, was another key development during the year.

Current aviation situation

Before proceeding with the outlook for FY2024… a brief review of the current situation based, on ground facts.

- Unmet domestic traffic demand of about 15+ million existed in FY2023 (150+ mn instead of 137 mn).

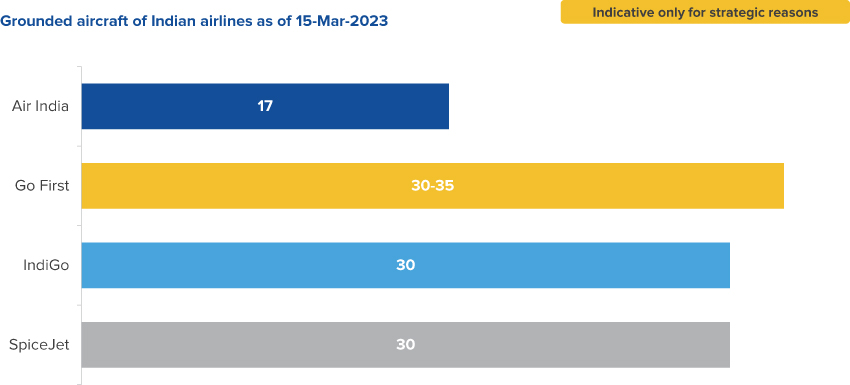

- 100+ aircraft are on the ground due to supply chain issues – situation unlikely to improve by Q1, or possibly even Q2 of FY2024. Maintenance costs for operationalising these planes could also impact industry P&L in FY2024.

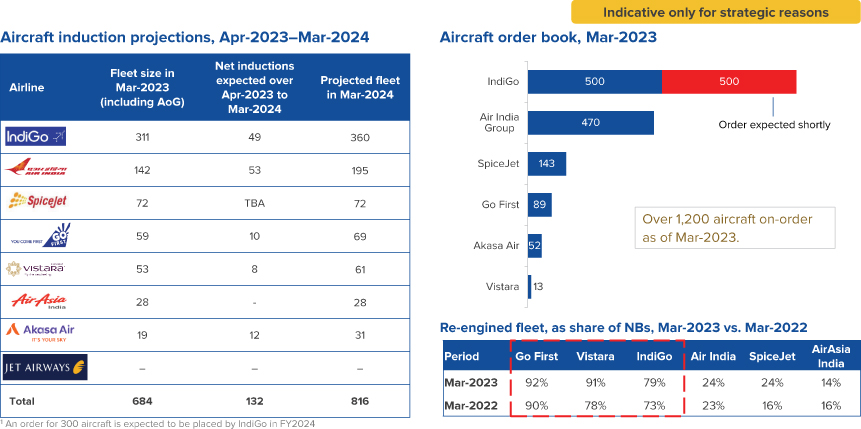

- 135+ aircraft expected to be inducted (net inductions) in FY2024.

- Shortage of experienced pilots, including for wide-bodies, and significant increase in cost per block hour of pilots.

- Shortage of other skilled resources across ATCOs, DGCA, airports, CISF etc.

- 120 aircraft in question – dependent on the outcome of successful of recapitalisation of a few airlines, which is likely.

- Industry consolidation, both domestic and international, may impact pricing and other dynamics.

- Airport capacity shortage, especially at peaks during H1FY2024. Additionally, airport capacity issues at tier 2 and 3 cities, which also has an impact on network development and fleet utilisation.

- Whilst international pricing is likely to hold in FY2024, especially until the Russia-Ukraine conflict and other factors are not over, domestic pricing will be critical for profitability, especially from H2FY2024.

- Focus on profitability and cash flows has to be balanced with the reality that significant capacity induction is planned, particularly from the second half, which may seriously compromise yields.

There are challenges, but we are on right path

Wilson campbell

Air India’s CEO Wilson Campbell said the merger within the group was work in process, and making good progress. There were challenges, like a temporary crew shortage for which reason a few of the flights were being curtailed. Refurbishment of the existing fleet was somewhat slower than expected. This was important to ensure a similar experience within the network. Grounded aircraft, at least 20 of them, were back in the air. He was confident loans were not going to be a problem, given the credibility of the new owners. The upfront part for immediate aircraft deliveries had been paid for, the augmentation was on track.

Air India’s CEO Wilson Campbell said the merger within the group was work in process, and making good progress. There were challenges, like a temporary crew shortage for which reason a few of the flights were being curtailed. Refurbishment of the existing fleet was somewhat slower than expected. This was important to ensure a similar experience within the network. Grounded aircraft, at least 20 of them, were back in the air. He was confident loans were not going to be a problem, given the credibility of the new owners. The upfront part for immediate aircraft deliveries had been paid for, the augmentation was on track.

Outlook for FY2024

Global macro-economic outlook for FY2024

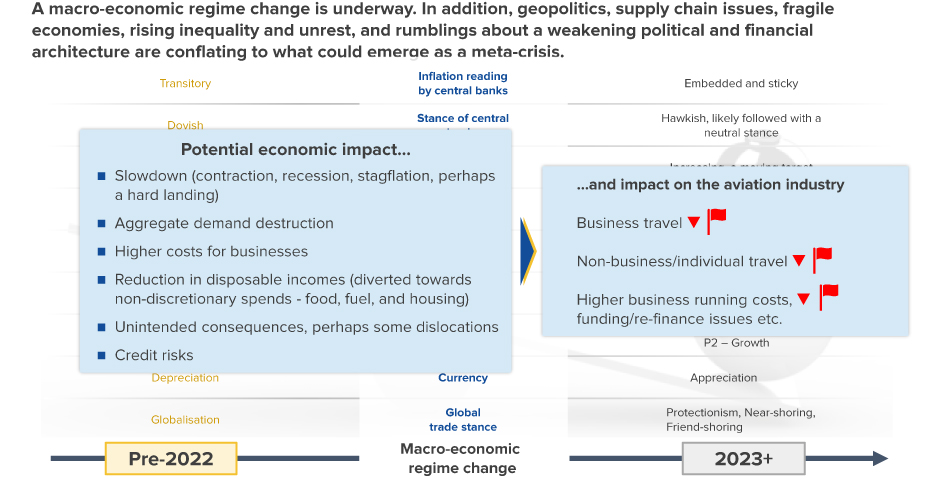

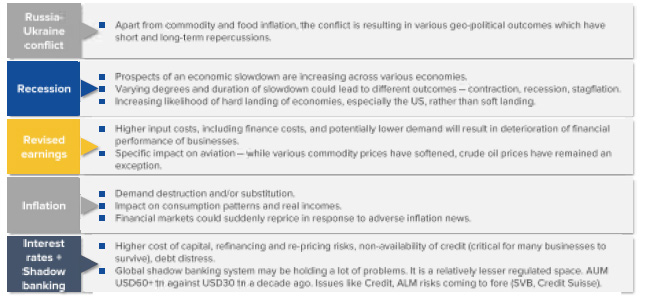

A macro-economic regime change is underway. In addition, geopolitics, supply chain issues, fragile economies, rising inequality and unrest, and rumblings about a weakening political and financial architecture are conflating to what could emerge as a meta-crisis.

From our perspective ‘3Rs & 2Is’ continue to drive key macro economic risks. Geo-politics and inflation continue to be the biggest spoilers for economies and businesses.

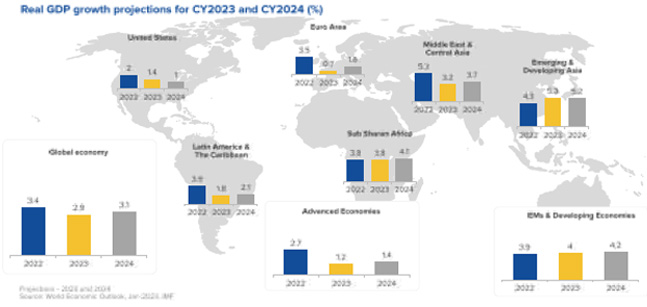

Global GDP: CY2023 peojected global growth of 2.9% is below historical average of 3.8% (CY2000-19). We believe multiple headwinds exert a downside risk to these projections.

we will focus upon newer connections globally

Pieter Elbers

IndiGo is embarking on the next level of growth and cost leadership is crucial for the airline, its CEO Pieter Elbers said at CAPA. Currently, IndiGo operates around 1,800 daily flights and has a fleet of more than 300 aircraft with a market share of over 55%. He noted that the V-shaped recovery of the country’s aviation sector has been a part of the growth story for the airline. The industry had hit almost the pre-pandemic numbers. Coming months will witness new numbers as the industry moves towards bigger growth.

IndiGo is embarking on the next level of growth and cost leadership is crucial for the airline, its CEO Pieter Elbers said at CAPA. Currently, IndiGo operates around 1,800 daily flights and has a fleet of more than 300 aircraft with a market share of over 55%. He noted that the V-shaped recovery of the country’s aviation sector has been a part of the growth story for the airline. The industry had hit almost the pre-pandemic numbers. Coming months will witness new numbers as the industry moves towards bigger growth.

He said the aviation industry was heading towards a more responsible and sustainable growth. As far as Indigo was concerned, while adding more city pairs and newer domestic destinations, the airline will focus upon newer connections globally to markets like Nairobi, Johannesburg and Jakarta.

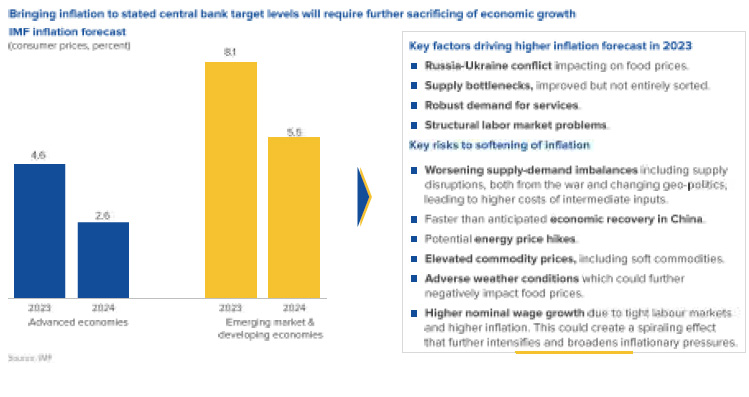

Inflation outlook: After the initial cool-off, inflation may remain persistent above target levels for longer. The risk of de-anchoring of inflation expectations still exists.

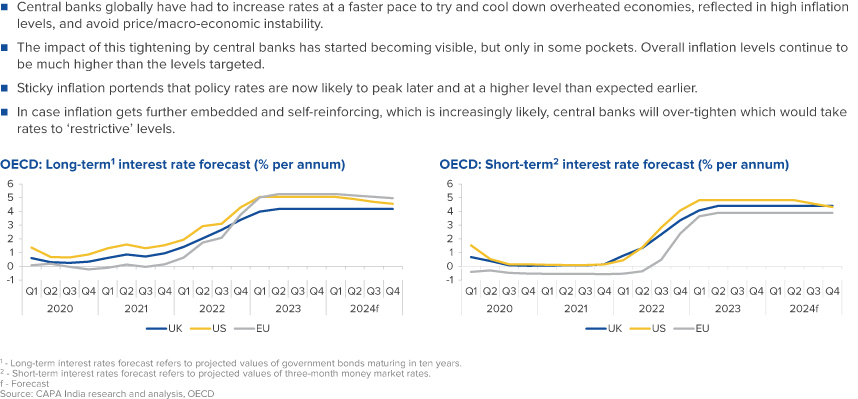

Interest rates outlook: FY2023 witnessed faster-than-expected increases in interest rates by major central banks. For FY2024 this pace of increase will reduce, but rates will remain elevated.

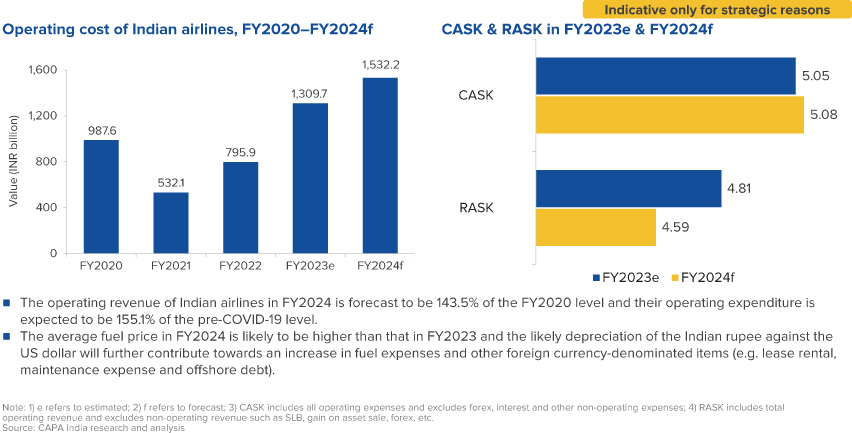

Crude oil outlook: For FY2024 we expect average crude oil price at USD80-90/bbl. We also expect volatility in prices to continue with prices oscillating between USD70-100.

Emirates chief warns limiting air traffic will hurt Indian airlines

The head of Emirates, Sir Tim Clark, said Indian airlines would lose out financially as a result of limited air traffic quotas between India and the UAE, which the Dubai-based operator believes should be increased. The UAE has asked the Indian government to approve 50,000 more seats on flights between the two countries, but India’s Civil Aviation Minister told Reuters it was not currently looking at increasing existing traffic limits.

The head of Emirates, Sir Tim Clark, said Indian airlines would lose out financially as a result of limited air traffic quotas between India and the UAE, which the Dubai-based operator believes should be increased. The UAE has asked the Indian government to approve 50,000 more seats on flights between the two countries, but India’s Civil Aviation Minister told Reuters it was not currently looking at increasing existing traffic limits.

Emirates president Sir Tim Clark told the Capa India Aviation Summit in New Delhi he saw scope for “at least double” the weekly limit of 65,000 seats. He emphasised how the cake was growing, it was not static, and it was for both sides to share it. If India embraced the so-called Open Skies policy with the UAE, it would grant airlines greater access to each other’s markets amid strong demand and rising competition, he said.

He did not regard Air India as an adversary and opined that Indian airlines might be losing money by prolonging what he sees as curbs on traffic. He thought they might be short changing themselves to the tune of about $1 billion a year as a result of the traffic restrictions. “We are hoping that the government will recognise the power of what we are talking about and that the Indian carriers, including Air India, will also say this is good for us,” Tim Clark said.

India macro-economic Outlook for FY2024

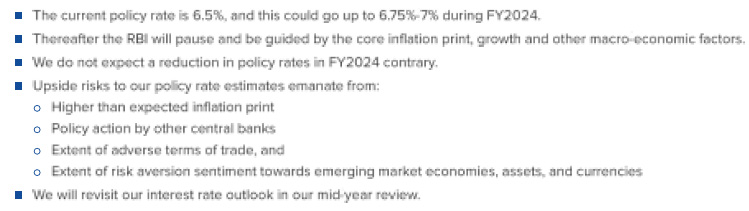

Interest rate outlook: At present we expect the RBI to hike interest rates by another 25-50 basis points followed by a pause. We do not expect a reduction in policy rates in FY2024.

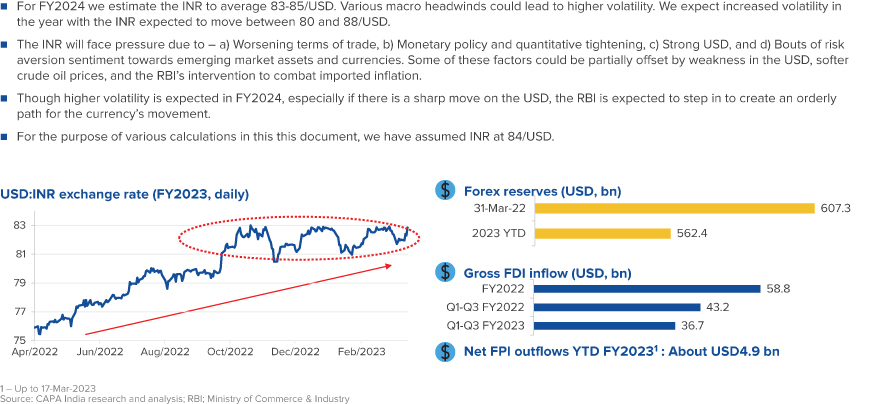

Exchange rate outlook: INR to average 83-85/USD in FY2024 but encounter higher volatility. Amidst volatility, the RBI will need to routinely step-in to ensure an orderly outcome.

India Aviation Outlook for FY2024

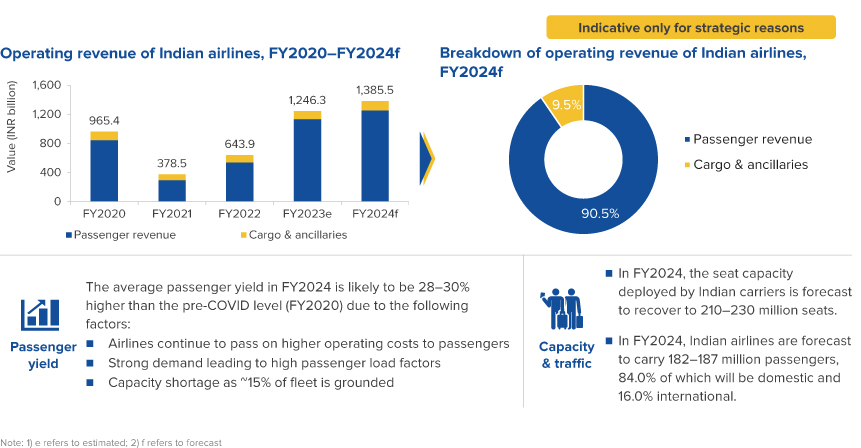

CAPA India expects domestic and international traffic to be in the range of 160+ million and 72-75 million in FY2024, respectively, with both increasing by 20% or more y-o-y.

Turkish Airlines offers some of the Best Connections out of India; Emphasises the Need for More Capacity

Bilal Ekşi

Turkish Airline CEO believes that giving more traffic rights is a win-win situation on both sides. He said Indian carriers would gain just as much with additional capacity. Recalling how he grew within the country’s aviation sector, he said his past experiences helped him, as he grew to becoming the CEO of the country’s leading airline.

Turkish Airline CEO believes that giving more traffic rights is a win-win situation on both sides. He said Indian carriers would gain just as much with additional capacity. Recalling how he grew within the country’s aviation sector, he said his past experiences helped him, as he grew to becoming the CEO of the country’s leading airline.

Emphasising how Turkish was a professionally managed airline, he touched upon the eco-system in his country where the airport operator and the airline, though with different ownerships, worked in tandem.

Bilal recalled how during covid, his airline won over the pilots and unions, by convincing them with a common cause refrain. Talking with them as brothers together, working with the same purpose, he was able to delay salaries till better times.

His tone was measured as he emphasised the audience how Turkey had become a destination for Indians for all reasons, from pure leisure to favourite wedding venues.

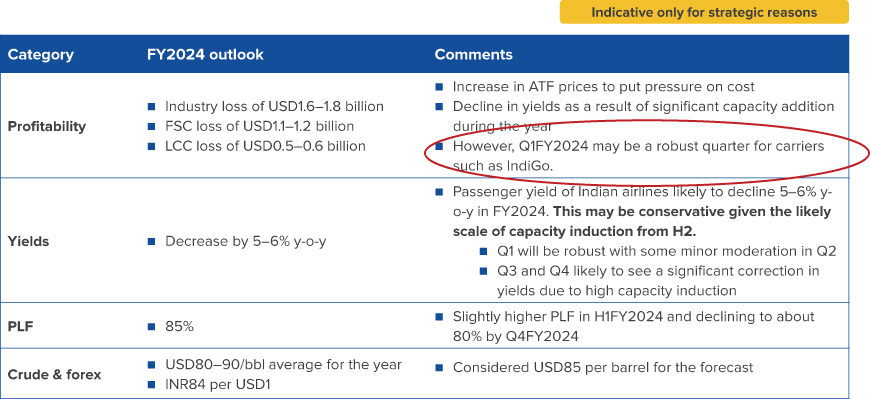

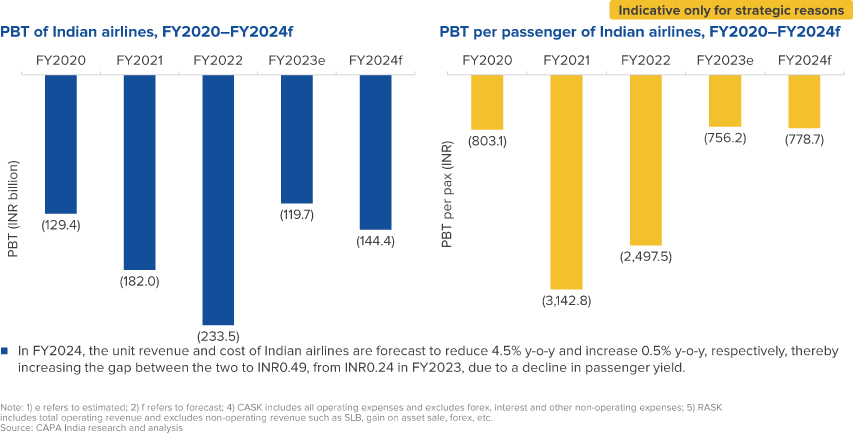

CAPA India expects the Indian airline industry to report consolidated losses in the range of USD1.6-1.8 billion for FY2024.

More than 100 aircraft (around 15% of the total fleet) are grounded due to supply chain and non-supply chain issues.

Indian airlines are projected to operate more than 800 aircraft by the end of FY2024, an increase of 132 aircraft vis-a-vis the level in FY2023.

Akasa’s focus stays strong, will start international by year end

Akasa is not focusing on market shares, competition, and prefers to have its own niche, with a single-minded devotion to customer care and profitability. Its focus is on connecting metro cities with tier 2 and tier 3. It is not going the ‘hub’ way and will connect any city pairs that make sense.

Akasa is not focusing on market shares, competition, and prefers to have its own niche, with a single-minded devotion to customer care and profitability. Its focus is on connecting metro cities with tier 2 and tier 3. It is not going the ‘hub’ way and will connect any city pairs that make sense.

Akasa has 19 aircraft presently, not a small number considering they started only last August. It will acquire its 20th aircraft later this year and become eligible for international operations. It believes Dubai is not the only concern as there are many other routes it can fly. It is also open to connecting foreign destinations to yet not tapped Indian cities.

In its summer schedule, the airline is operating 751 weekly flights. By the end of June, this number will rise to 925. The airline is already considering placing another aircraft order. There is talk of a three-digit order, reflecting strong faith in its flight path.

In FY2024, Indian airlines are forecast to generate operating revenue of INR1,385.5 billion (USD16.5 billion), 43.5% higher than the pre-COVID level.

In FY2024, Indian airlines are projected to have operating expenditure that is 55.1% higher than the pre-pandemic level.

Indian airlines are forecast to incur a loss before tax of INR144.4 billion) in FY2024, translating into an INR778.7 (USD9.3) loss per passenger.

For Spicejet, 737 Max’s grounding was bigger disaster than covid

SpiceJet had placed an order for 155 Max planes in 2017, and at the time of grounding in March 2019, it had 12 of them in its fleet.

SpiceJet had placed an order for 155 Max planes in 2017, and at the time of grounding in March 2019, it had 12 of them in its fleet.

SpiceJet’s DNA is to never sit and pity itself, and it always wants to move forward, Singh said. “It is the DNA of SpiceJet: We refuse to die,” he said.

Presently, it was focused on reducing debt, and he assured the audience at the CAPA meet that the airline will show a vastly different balance sheet over the next few quarters. SpiceJet has been dealing with a shortage of funds, leading to delays in payment of dues to lenders such as aircraft lessors. Recently, it restructured its dues of more than $100 million to Carlyle Aviation by giving them a 7.5 per cent stake. He said he was open to similar arrangements to tide over other outstanding dues, to deleverage its balance sheet.

Guidance and strategic issues in FY2024

Mid-term outlook to FY2030