Green hydrogen will be a critical industrial fuel of the 21st century. India is well-positioned to show leadership

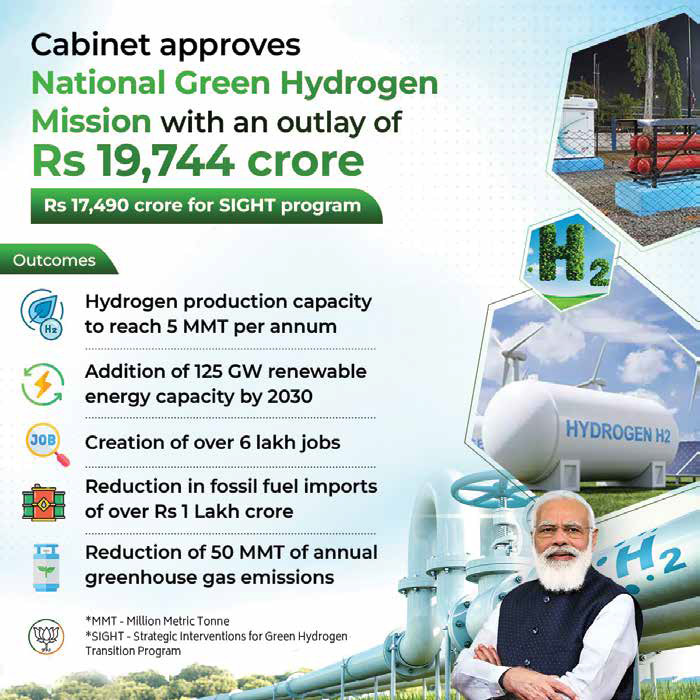

The 2023 Union Budget has allocated `19,700 crore for the National Green Hydrogen Mission. This will set in motion a programme that can position India as a green hydrogen (super)power. Why is this important and what will it take?

The 2023 Union Budget has allocated `19,700 crore for the National Green Hydrogen Mission. This will set in motion a programme that can position India as a green hydrogen (super)power. Why is this important and what will it take?

India has committed to 50% electricity capacity from non-fossil sources by 2030. But an energy transition in industry is needed at the same time. Most industrial greenhouse gas emissions in India come from steel, cement, fertilizers and petrochemicals.

Green hydrogen holds the promise of fuelling industrial growth while simultaneously reducing industrial emissions. Splitting water into hydrogen and oxygen is energy-intensive. When this energy comes from renewable/non-fossil sources, we get green hydrogen. It can serve as an energy source (heavy industry, long-distance mobility, aviation, and power storage) and an energy carrier (as green ammonia or blended with natural gas).

India is targeting at least five million tonnes of production by 2030, which is larger than that of any single economy. This would create demand for 100-125 gigawatts (GW) of renewable energy, 60-100 GW of electrolysers, investment opportunity of `8 lakh crore, and cut 50 MMT of annual emissions. With abundant sunshine and significant wind energy resources, India is geographically blessed to become one of the lowest-cost producers of green hydrogen.

Five priorities

For the vision to convert into reality, government and industry must act in sync along five priorities. First, domestic demand is critical. If we are not a big player domestically, we cannot be a major player in the international market. The mission introduces a Strategic Interventions for Green Hydrogen Transition (SIGHT) fund for five years, with `13,000 crore as direct support to consume green hydrogen. This will encourage heavy industries to increase demand, offering economies of scale by which suppliers can reduce prices.

Blending mandates for refineries can be another demand trigger. Urea plants have been exempted. Over time, targets can be ratcheted up with blending mandates rising (including for urea fertilizers). Another approach is to leverage government procurement. As the second-largest steel producer in the world, can India aspire to become the largest green steel producer? Costs of green steel, made from green hydrogen, are currently much higher, but could be reduced with economies of scale and changes in production technologies. A share of government procurement of steel could be nudged towards green steel. India could later position itself as a green steel exporter.

Second, India can be an attractive destination for domestic and foreign investment. Green hydrogen production projects announced/underway in India are far fewer compared to others. Green hydrogen is difficult and expensive to transport. The mission envisions green hydrogen hubs to consolidate production, end use and exports. A mission secretariat can ensure project clearance is streamlined and reduce financial risks.

Third, the SIGHT fund offers `4,500 crore to support electrolyser manufacturing under the performance-linked incentive scheme. Currently, manufacturers are importing stacks and assembling them. We must become more competitive — with targeted public funding — in manufacturing the most critical and high-value components of electrolysers in India. Not targeting value addition would result in electrolyser technologies and production again getting concentrated. China could end up controlling 38% of electrolyser capacity by 2030. Electrolyser technology must be improved to achieve higher efficiency goals, specific application requirements, be able to use non-freshwater, and substitute critical minerals.

Third, the SIGHT fund offers `4,500 crore to support electrolyser manufacturing under the performance-linked incentive scheme. Currently, manufacturers are importing stacks and assembling them. We must become more competitive — with targeted public funding — in manufacturing the most critical and high-value components of electrolysers in India. Not targeting value addition would result in electrolyser technologies and production again getting concentrated. China could end up controlling 38% of electrolyser capacity by 2030. Electrolyser technology must be improved to achieve higher efficiency goals, specific application requirements, be able to use non-freshwater, and substitute critical minerals.

Fourth, establish bilateral partnerships to develop resilient supply chains. Globally, about 63 bilateral partnerships have emerged; Germany, South Korea and Japan have the most. Using yen- or euro-denominated loans for sales to Japan or to the EU, respectively, could reduce the cost of capital and help us become export competitive.

Many bilateral deals focus on import-export but few deal with technology transfer or investments. India must cooperate with like-minded countries on trade, value chains, research and development, and standards. The mission allocates `400 crore for R&D, which can be leveraged to crowd in private capital into technology co-development. Indian companies should consider joint projects in countries with good renewable energy resources and cheap finance.

Finally, India must coordinate with major economies to develop rules for a global green hydrogen economy. In the absence of common global frameworks, attempts for rules and standards are being driven by collectives of private corporations rather than through structured intergovernmental processes. There are already signs of conflicting regulations and protectionist measures in major markets. These put India’s ambitions at risk.

India’s G20 presidency is an opportunity to craft rules for a global green hydrogen economy. These rules must address operational threats, industrial competitiveness and strategic threats. India should promote a global network on green hydrogen via which companies could collaborate. Green hydrogen will be a critical industrial fuel of the 21st century. India is well-positioned to show leadership — in our collective interest and that of the planet.

ABOUT THE AUTHOR

Dr Arunabha Ghosh is an internationally recognised public policy expert, author, columnist, and institution builder.

Dr Arunabha Ghosh is an internationally recognised public policy expert, author, columnist, and institution builder.

He is the founder-CEO of the Council on Energy, Environment and Water.