INDIA HAS TO ASPIRE TO THIS TRANSFORMATIVE VISION WHICH MUST BE SHARED BETWEEN GOVERNMENT AND INDUSTRY, AS JOINT STAKEHOLDERS

In this special CAPA study, the consultancy major talks of the huge potential that India has in terms of growing its air transport. It states that all interests must come together to share a common vision and grow in harmony, keeping in mind that cake is getting bigger and bigger.

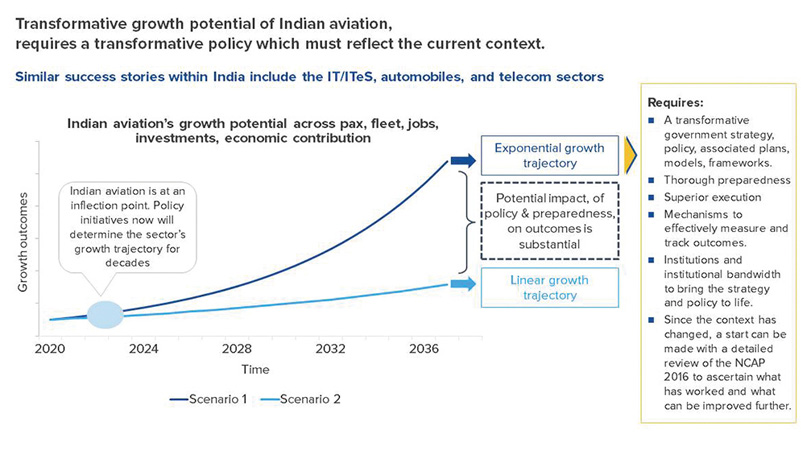

Indian aviation is at a critical inflection point. The opportunities could have positive implications for generations to come. But there are critical challenges to address if these opportunities are to be realised

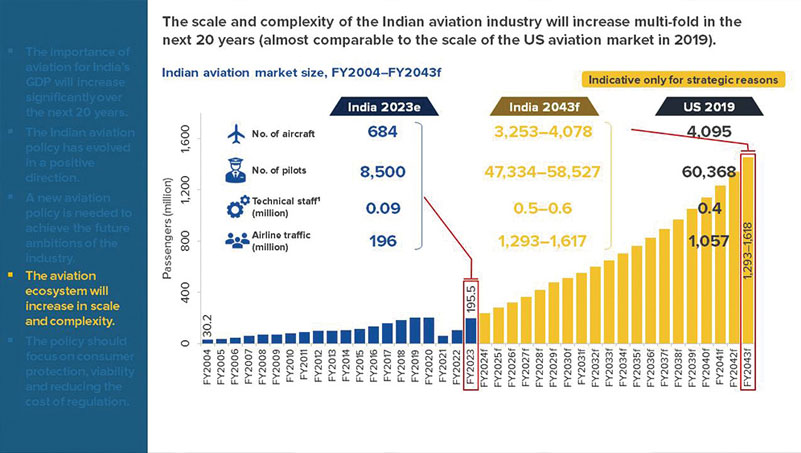

- India’s aviation system handled just less than 200 million airline passengers in FY2023.

- CAPA India projects that it may need to be able to handle around 1.3+ billion passengers within 20 years if an aspirational and transformational path is pursued (or around 1.0 billion passengers following more linear growth)

- Achieving such a dramatic ramp-up in scale will require a tremendous effort across the aviation eco-system.

- Each and every element of the industry will need to play their part to realise this opportunity.

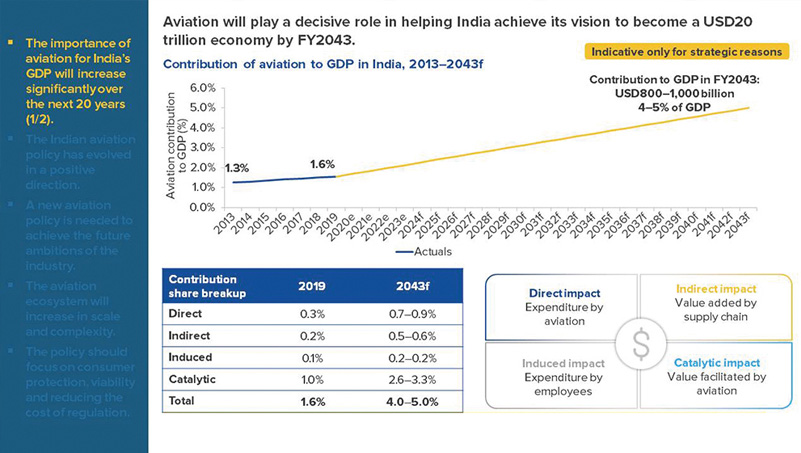

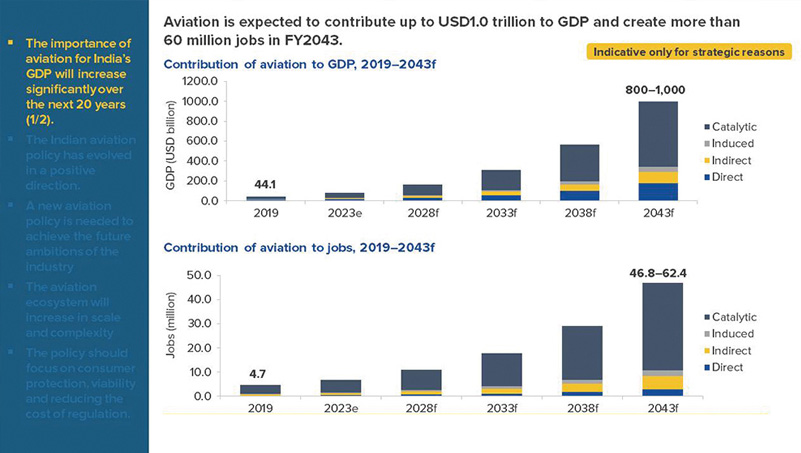

By FY2043 aviation could make a USD1 trillion annual contribution to the Indian economy, taking into account direct, indirect, induced and catalytic impacts and an aspirational and transformational vision. Otherwise around USD800 billion.

- In the aspirational scenario, India in FY2043 may be larger than the USA pre-COVID. In just 40 years, the Indian market would have grown from the size of Las Vegas to the size of the entire USA.

- Under a ‘business as usual’ scenario, India may be similar in size to China pre-COVID.

- The strategic impact that aviation could have on the economy and consumers, should inspire policy-makers, as well as industry leaders.

- MoCA has been making serious and genuine efforts to transform the sector and will need to look at a new policy framework to achieve the industry’s potential.

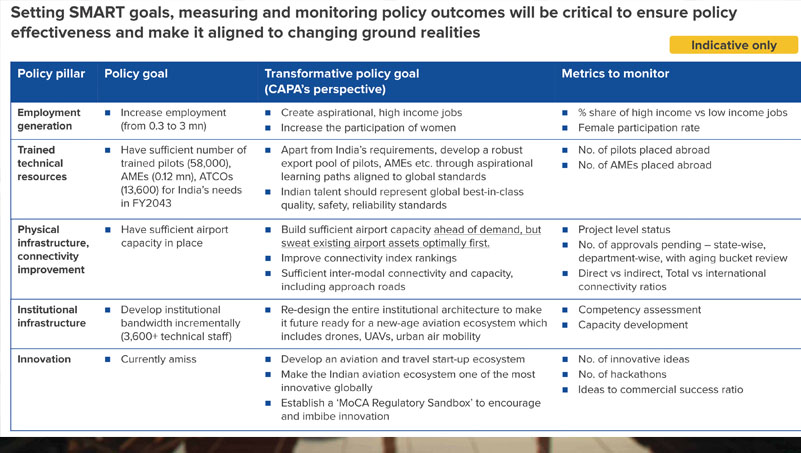

CAPA India has extensive experience in policy and regulatory advisory. This document provides our perspective on the need to achieve the following…

- To develop a new vision for the sector

- To set aspirational goals, which may seem ambitious today, but have the potential to be reality

- To provide the necessary institutional and business framework

- To ensure that the requisite physical, manpower and digital assets are available

- To measure and track performance to ensure that outcomes are aligned with intent

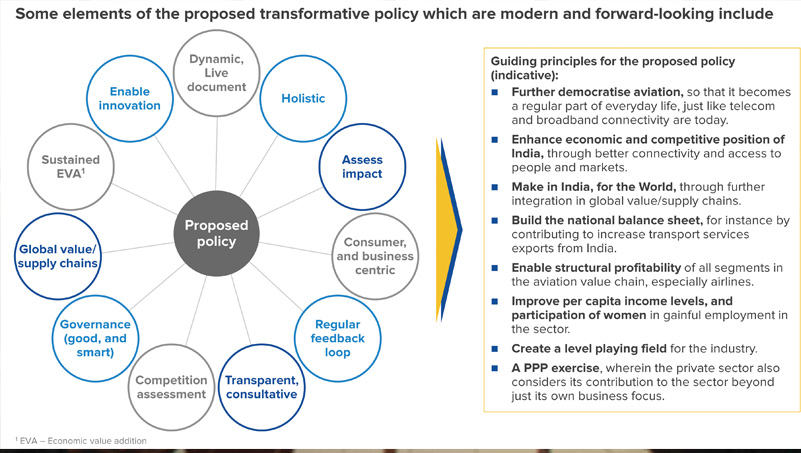

Preparing for the projected growth will require a new mindset.

- A national vision must be developed that is shared by government and industry.

- There must be a recognition that aviation can make an annual contribution of USD1 trillion (direct, indirect, induced and catalytic) to the Indian economy by FY2043, if India chooses to aspire to a transformative vision.

- Closer and more strategic cooperation is required between central government, state government and industry. Achieving outcomes is a shared responsibility.

- Translating the vision and ambitions into outcomes will require:

- A comprehensive White Paper which accurately captures the current status of the sector in terms of capacity and capabilities, and identifies the structural gaps that exist.

- Extensive, documented consultation with the Indian and global industry in a professional and structured manner.

- Development of a long-term aviation policy. This policy, which should be realistic and implementable, should span the entire value chain. The policy must not only plan for growth, but also optimise existing assets.

- Simultaneous preparation in terms of critical planning and execution capability. These skills must be institutionally developed within MoCA, resulting in a world class planning team that has a deep understanding of a modern and dynamic aviation sector.

- A performance tracking and measurement model to ensure that the policy is implemented effectively.

Airspace design need to be restructured to provide capacity for up to 8-10x current traffic, plus continued growth in overflights, general aviation and new age aviation e.g. air taxis, UAVs and eVTOL aircraft

- Airspace capacity needs to meet long-term requirements

- Airspace must deliver the most efficient flight paths possible, for lower costs and sustainability

- Airspace must transition to full performance-based navigation

- For this to happen

- Corporatisation of the ANSP arm of the Airports Authority of India should commence immediately

- The ANSP must have a professional and expert-led governance structure

- Civil operations must be given access to a greater share of airspace

- Technical constraints must be removed to make the sector more sophisticated

Planning for airport capacity that will last for generations, and is developed ahead of demand, must start now.

The emergence of Indian mega-carriers will require appropriate airports to be developed.

- Delhi and Mumbai will soon have second airports, but they need to start preparing for their third.

- Bangalore, Hyderabad, Kolkata and especially Chennai, need to start thinking about second airports.

- Given the projected growth, these airports cannot be for ‘just’ 60-80 million passengers. Otherwise, Indian metros will be building new airports every decade.

- Instead, the next airports should be located where they can have longevity, like Istanbul or Dubai World Central, with potential capacity of up to 200 million passengers per annum.

- But this needs:

- Preparation, preparation, preparation

- A shared vision

- CRITICAL Land to be notified as soon as possible (this will become an increasingly scare commodity)

- CRITICAL Sweating of existing airport assets

- Integration with state and regional master plans, including provisions for access infrastructure

- Clarity on whether we want existing airports to grow into mega-airports, or we want competition from second and third airports.

- Plans to be shared with Indian and global airlines so that they can take appropriate long-term fleet and network planning decisions.

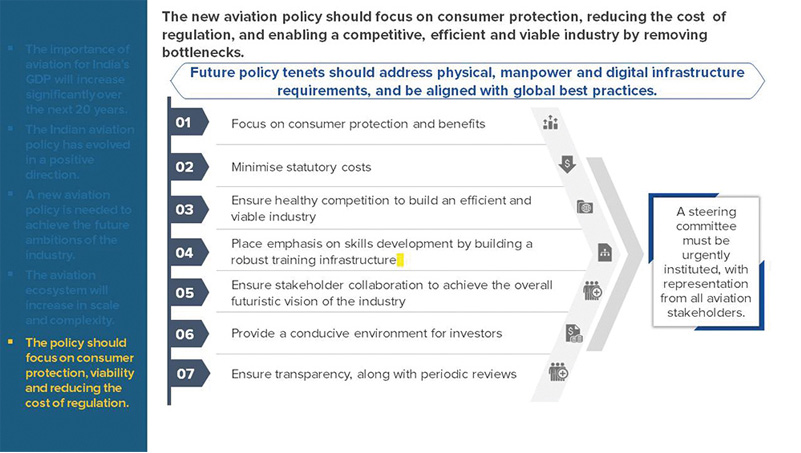

Aviation policy must deliver industry viability and growth by design. The areas highlighted below are just a sample of the areas that require attention.

Airline viability

- Carriers must be provided with a level playing field by dismantling the negative fiscal regime and providing infrastructure ahead of time. System efficiency must be maximised to enable the emergence of mega-carriers.

Bilateral policy

- India must first define an international air services strategy in line with its national interests.

- Once this has been defined, the corresponding bilateral policy can be formulated. But it must be transparent, equitable and designed to maximise growth.

- India will be such a lucrative market in the years and decades to come that aero-politics will become very complex unless there is a clearly-defined policy. This may need to take non-aviation issues into account (e.g. geo-politics, trade, energy, security, diaspora affairs etc.) when determining how to allocate entitlements between countries.

- And challenges may arise even domestically, as airlines and airports are likely to have competing objectives, and even airlines themselves will have differing views.

MRO Policy

- India needs to decide whether it requires an MRO system primarily for Indian carriers, or whether it is intent on building a global centre for maintenance.

- Mega-carriers will need massive MROs. That will require a policy that delivers the requisite cost base, skills and infrastructure.

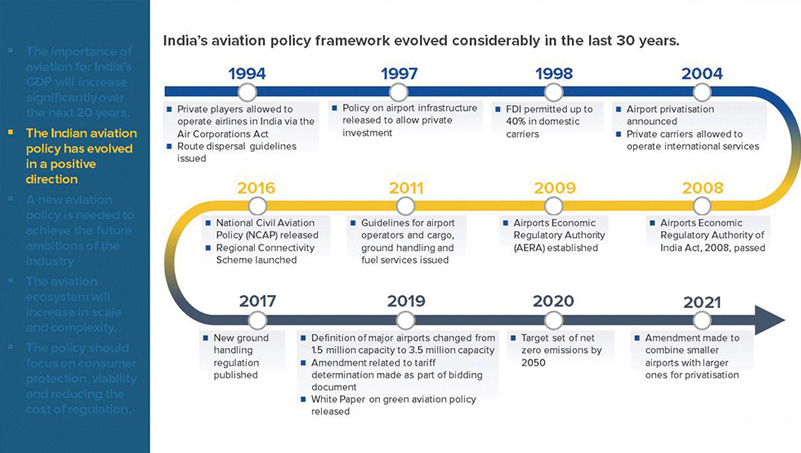

Why do we think this aspirational vision is possible? Because aviation is being taken more seriously in India than ever before. This creates an environment in which the design of a suitable long-term policy is possible.

- Privatisation of Air India was a significant and bold reform. Taking a haircut of INR60,000crs and possibly realising only INR8,000-10,000crs has re-set the industry and resulted in a new wave of optimism about the future.

- Serious and determined focus by the government to convince states to reduce VAT on ATF is delivering results. The majority of states have rationalised taxes, with Assam and West Bengal possibly next. Larger states have been holding out, but the recent reduction in VAT in Maharashtra is a positive development.

- The role of private airports – which already handle the majority of traffic in the country – is set to increase, with 25 non-metro airports identified for privatisation, a greenfield airport likely in Chennai, and Navi Mumbai and Noida airports on track to open in the next couple of years.

- MoCA is engaging seriously with airlines and airport operators to facilitate the development of genuine hubs in India.

- India has an LCC and an FSC that have the genuine potential to become world class, global mega-carriers.

- MoCA is actively consulting with the industry to address strategic challenges.

These developments provide India with the option to consider an aspirational, transformational vision. But the scale and complexity of operations is on a scale that may be unimaginable today, and therefore has to be built by design.

ABOUT CAPA India

CAPA India was established more than 19 years ago with a mission to become a leader in global aviation knowledge. We have since built a worldwide portfolio of clients and experience, and an enviable reputation for independence, insight and integrity. Today aviation businesses around the world turn to us for sound advice and research.

CAPA India was established more than 19 years ago with a mission to become a leader in global aviation knowledge. We have since built a worldwide portfolio of clients and experience, and an enviable reputation for independence, insight and integrity. Today aviation businesses around the world turn to us for sound advice and research.